Consumer Staples is an ASX sector we can all relate to. It includes companies that produce and distribute the basic everyday essentials we all need.

People need food, drinks, household and personal hygiene products whether the economy is in boom or bust.

It can be seen as a defensive sector because of the essential nature of everyday basics, so we still expect it to perform relatively well when times are tough.

The consumer staples sector contains a lot of food-based companies. Growth, production and distribution of food all touch on many ethical considerations – land clearing, meat consumption, modern slavery, GMO foods, pollution, animal cruelty and climate impacts – so it's also an important sector for Australian Ethical when it comes to putting ethical frameworks into practice.

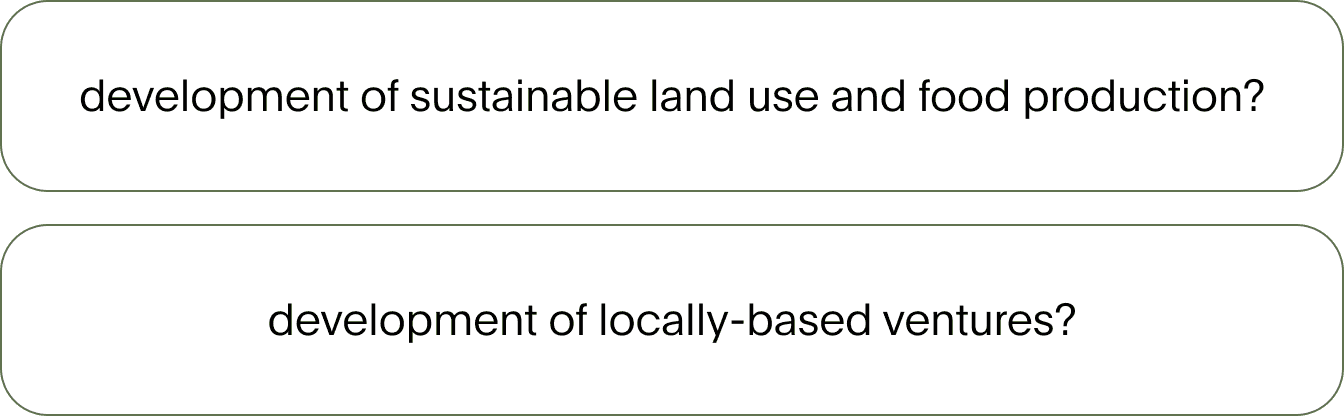

So, how do we decide if a company belongs in our investable universe?

![]()

Industry frameworks

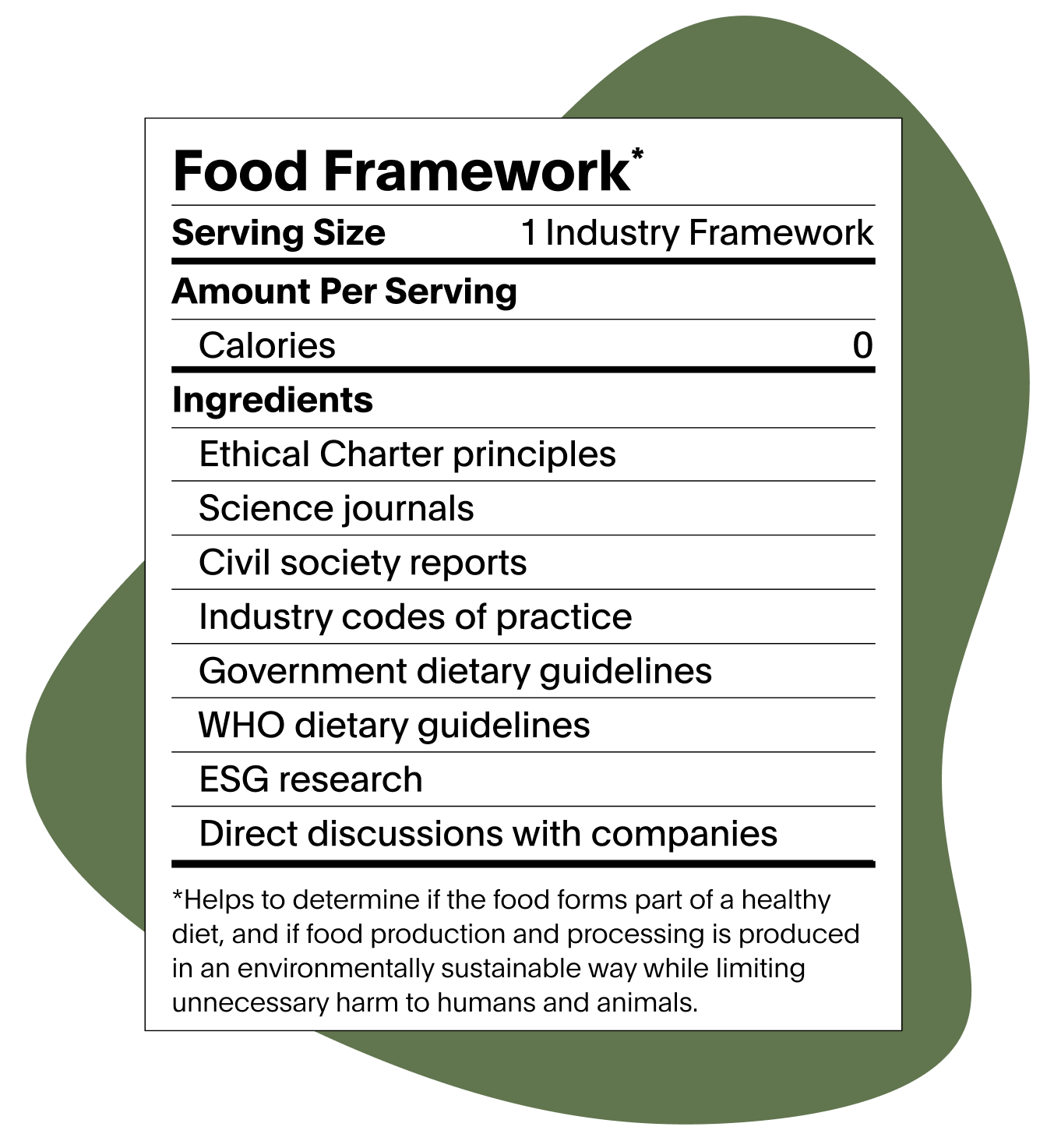

First, we use our industry frameworks to determine if we should support or avoid a company.

Our frameworks are built on the principles of our Ethical Charter, which hasn't changed since 1986.

Consumer Staples is covered by our Food Framework, and our Retail Framework. We also apply our Human Rights Framework to all our investments, regardless of the industry. Let's use the food industry as an example:

What are the positives?

Guided by our Charter, we ask questions to determine if this is an investment we should support. For example, do their activities include...

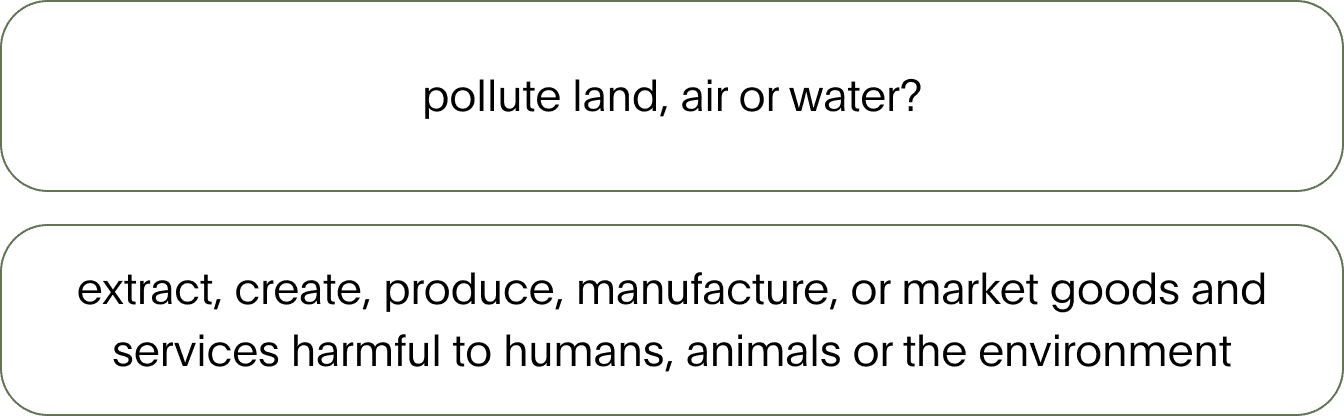

And what are the negatives?

Guided by our Charter, we ask questions to determine if this is an investment we should avoid. For example, do their activities unnecessarily...

Some company activities conflict with our positions on issues, such as our stance on conventional fish farming. We can rule out these investments straightaway if the company’s involvement exceeds our tolerance thresholds.

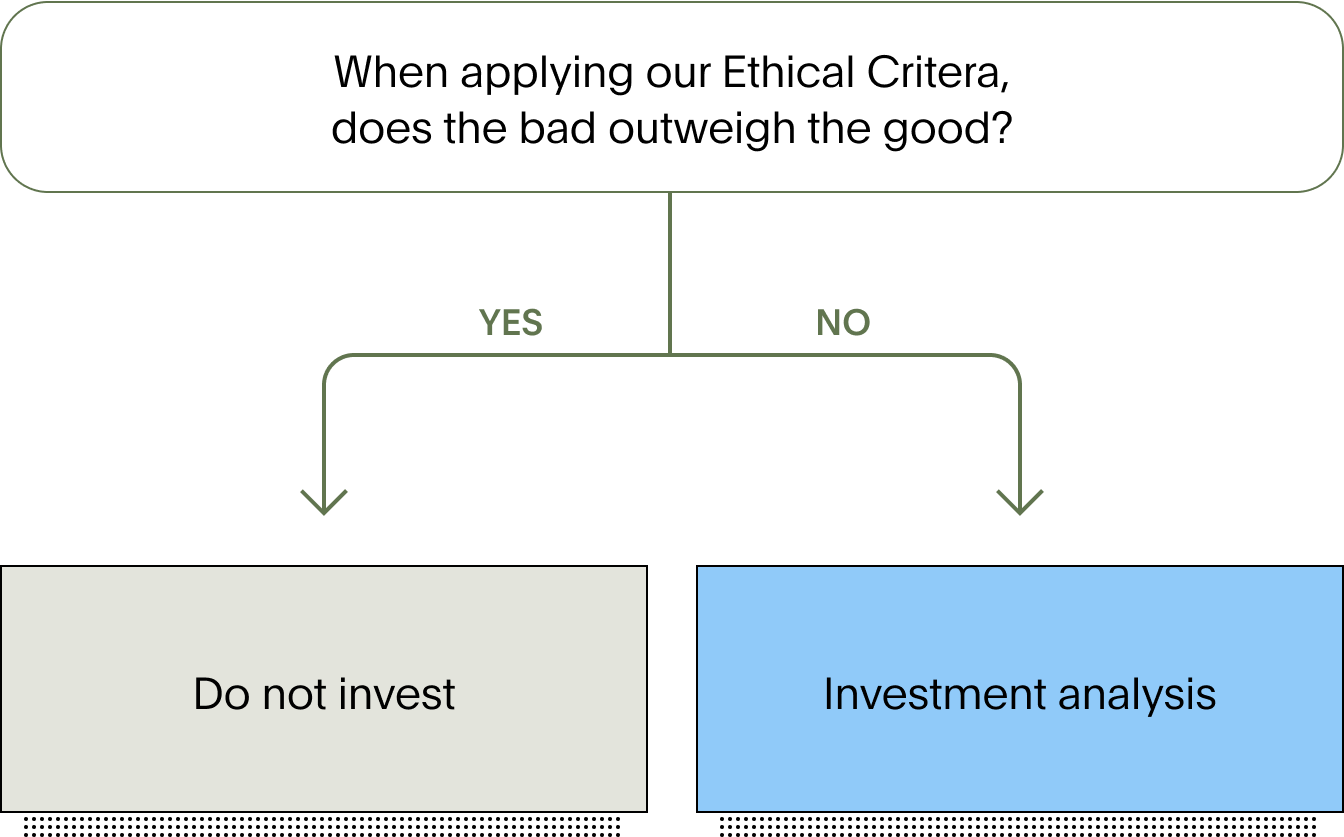

Next, is a balancing act.

A company needs a ‘starting positive’ in order to be considered for our investable universe.

![]()

Food is good, we need it. But it has a high impact on climate change, biodiversity loss, animal welfare, human rights, and other environmental impacts such as water pollution and soil degradation.

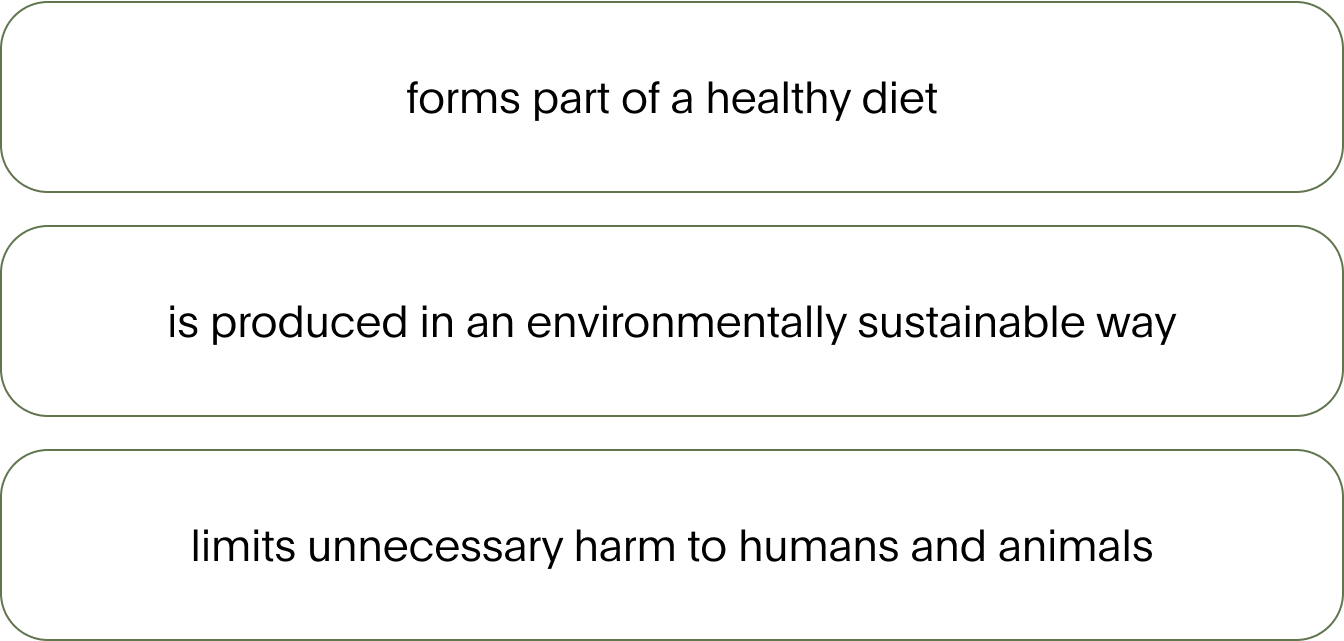

We only invest in sustainable food production. We consider food sustainable and positive if it meets the following criteria:

Based on this framework, we restrict+ investment in conventional animal agriculture as it fails on the environment and animal protection grounds. Instead, we’re focusing on plant-based nutrition.

We exclude producers earning over 10% revenue from conventional animal agriculture and processors earning over 33%.

Our frameworks draw from extensive research and require ongoing analysis.![]()

Company examples

Each company needs to pass ethical screening and meet our investment criteria before we invest.

Noumi Limited

Ethical screening ![]()

This company was ruled out in 2018 because over 33% of the company’s revenues came from conventional dairy. We restrict+ investment in conventional dairy because of its environmental impact as well as animal welfare concerns..

Blackmores

Ethical screening ![]()

Investment analysis ![]()

We are invested in Blackmores. Although their revenue from fish oil products is below our thresholds, we have engaged with them on their investment in plant-based sources of Omega-3.