Turning off finance for fossil fuels

To reach net zero by 2050, we need to switch off the funding that enables unsustainable fossil fuel expansion, and we need massive investment in clean energy systems.

Large financial institutions are one key to achieving this, as they can support the massive shifts in capital needed to combat climate change.

Funding a low-carbon future

For years we have leveraged our investment in the finance sector to help turn off sources of funding that enable unsustainable fossil fuel expansion to continue. We actively campaign for large financial institutions to:

Align their lending, underwriting and investing with the goals of the Paris Agreement

Stop financing fossil fuel projects that are not aligned with the Paris Agreement

Direct more funding to positive, clean and sustainable energy solutions

Influencing the finance sector to cut fossil fuels

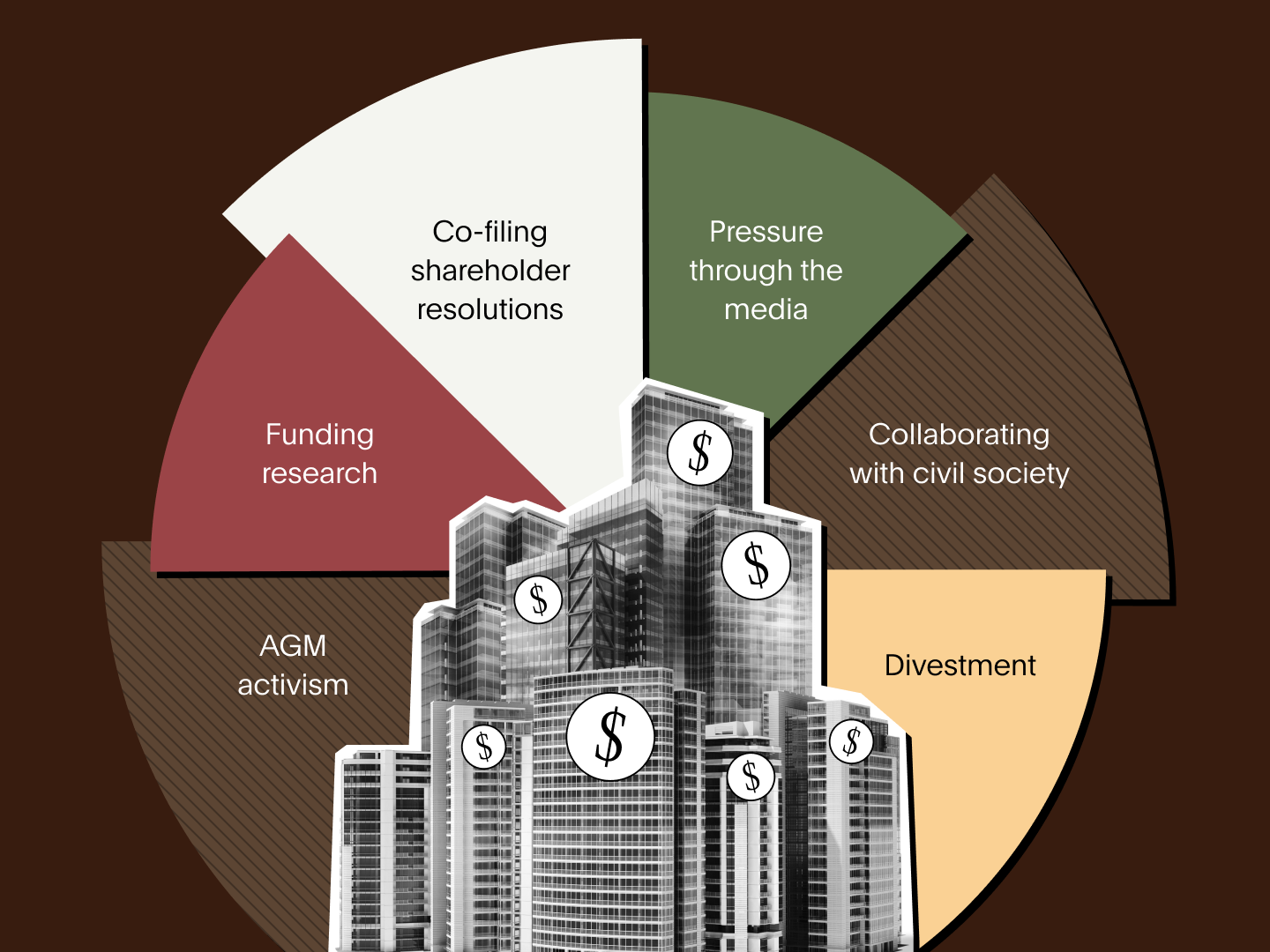

Change of this magnitude requires coordination and persistence. We use all our stewardship tools to influence the banks and insurers, including collaborating with civil society, co-filing shareholder resolutions, AGM activism, using the media to call out recalcitrant companies, funding research, and where necessary, divestment.

2013

We asked the Big 4 Australian banks to disclose the amount they lend to coal, oil and gas.

![]()

2015

We called on finance companies to align large-scale lending to the Paris Agreement.

![]()

2017

![]()

MILESTONE WIN

Westpac and NAB announced exclusions for new thermal coal projects, including Adani Carmichael.

![]()

2019

![]()

MILESTONE WIN

QBE announced a phase-out of its coal exposure after we co-filed a shareholder resolution with Market Forces.

![]()

2020

We divested from Marsh McLennan as their vague commitment to climate goals fell well short of what we asked.

We co-filed a shareholder resolution calling on QBE to align its underwriting and investments of oil and gas assets with the Paris Agreement, and at its AGM pointed out that many of its customers are not Paris aligned.

At NAB and Westpac’s AGMs we supported shareholder resolutions calling for Paris-aligned targets to reduce fossil fuel exposures and transparency about how any new fossil fuel finance is consistent with their net zero by 2050 commitments.

![]()

MILESTONE WIN

The banks made some progress in FY21:

-

NAB announced a cap on its exposure to the oil and gas sector, along with restrictions on lending for greenfield oil and gas extraction projects.

-

Westpac announced requirements for public Paris-aligned business goals for new oil and gas exploration, production and refining customers.

-

ANZ set a reduction target of 50% for the emissions intensity of its global power generation portfolio by 2030.

-

All banks made commitments to publish further detail of climate-related targets and criteria in 2022.

While it is good to see some progress, it is not enough. To reach net zero by 2050, gas needs to decline this decade. We recognise it can be complicated to evaluate whether an individual company or a project is Paris aligned. But that’s not an excuse to continue business as usual.

FUNDING INDEPENDENT RESEARCH

We co-financed and contributed to an IGCC-commissioned1 report examining high-impact planned Australian gas projects and their risks for non-alignment with the Paris Agreement. This will be used to hold financial institutions and their customers to their Paris Agreement commitments.

We met with QBE’s Sustainability team to understand how they were progressing on oil and gas exposure. We were disappointed with lack of ambition, including:

- its postponement of assessment and action in the oil and gas sector to 2030 (and even to 2040 for companies with up to 59% revenue from oil and gas extraction);

- no date set to assess Paris-alignment for companies with less than 30% revenue from oil and gas extraction;

- and restrictions not being applied to treaty reinsurance of oil and gas exposures.

We co-filed a shareholder resolution with Market Forces calling on QBE to disclose in its annual reporting:

- short, medium and long-term targets to reduce investment and underwriting exposure to oil and gas assets that are consistent with the climate goals of the Paris Agreement; and

- its plans and progress to achieve those targets.

At QBE's AGM we challenged their policy to wait until 2030 to start restricting its insurance of expansion of the oil and gas sector. We highlighted that QBE was falling behind its competitors in setting restrictions for the oil and gas sector.

![]()

SHORT-TERM WIN

QBE

After the AGM, QBE asked our Head of Ethics Research to meet with the company’s new CEO.

QBE has joined the Net Zero Insurance Alliance, a UN-convened group of insurance companies that requires they:

-

transition all operational and attributable greenhouse gas emissions from their insurance and reinsurance underwriting portfolios to net-zero emissions by 2050; and

-

set intermediate science-based targets every 5 years and publish these.

Where we draw the line

- We expect large institutional banks to be taking action to align their lending with the Paris Agreement.

- We won’t invest in any bank which lends to the mine formerly known as the Adani Carmichael coal mine.

- We look at the way banks facilitate financing by others, e.g. how they might help companies raise financing for environmentally friendly initiatives, including through instruments such as green bonds.

- We expect large insurance companies to be taking action to restrict underwriting of new projects which are not aligned to the Paris Agreement.

- We divested from major energy insurer Travelers, which refused to expand its limited fossil fuel underwriting restrictions.

- We divested from insurance broker Arthur J Gallagher for its lack of climate criteria or targets.

We cannot take credit for all this work. We work with Australian and overseas investors, civil society organisations including Market Forces and the Australian Centre for Corporate Responsibility. All the wins we have had to date are attributable to pressure that has been applied from every direction.

1. Investor Group on Climate Change

Explore