Get the most out of your super

Getting on top of your super can seem a little overwhelming at first, but it’s much easier than you might think. We’ve divided it up into four bite-sized pieces so you can approach it one step at a time. Once you’ve ticked all four boxes you can sit back in the knowledge that your super is doing good for you as well as doing good for people, animals and the planet.

If you have multiple super accounts, you can increase your positive impact by combining them into ethical investments. The more money invested in renewable energy, health tech and sustainable products the better. And having multiple super accounts is not only an administrative challenge, it’s also very expensive as you will have multiple sets of administration, investment and insurance fees. This can really add up over decades and significantly reduce your retirement nest egg. Combining all of your super accounts into one place is one of the most effective things you can do to build your super balance.

Did you know?

According to the Australian Taxation Office, there is $17.5 billion in lost and unclaimed super across Australia. Over 15.6 million Australian have a super account and of those people, approximately 39% have more than one account. Over 2 million Australians have over three accounts, and 156,000 people have 6 or more (ATO 30 June 2018).

See instructions to combine superOnce you’ve consolidated all of your super accounts into one place, the next step is to make sure your employer knows where to send your money. Under Australian law, your employer is required to contribute 11.5% of your salary into a complying super fund. These are called Superannuation Guarantee (SG) contributions and are paid in addition to your salary. The SG has been legislated to rise incrementally each year until it reaches 12% on 1 July 2025.

However, it’s up to you to tell them which fund to send your money to. If you don’t specify a fund, your employer will simply choose a fund for you (‘default fund’) – which is how so many Australians end up with multiple accounts. For new employment arrangements entered into from 1 November 2021, the super account that is receiving your SG contributions will be ‘stapled’ to you as you move through employment unless you choose otherwise. If you are receiving contributions for the first time, unless you make a choice, they will be placed in your employer’s default fund.

All you have to do is complete the Choice of super fund form and hand it to your employer. The bulk of it has been prefilled with our fund details and the only thing you need to add is your name, date of birth, member number and a dated signature.

Other ways to boost your balance

- ’Salary sacrificing’ is a great way to boost your super balance and save some tax in the process. Under a salary sacrificing arrangement, you agree to direct some of your pre-tax salary into your super fund. The ‘sacrificed’ component of your salary will be taxed at the concessional rate of 15% rather than your marginal tax rate (which could be as high as 47%).

- Be aware of the concessional contribution cap which is all about how much super you can pay into your account each year before you start getting taxed at a non-concessional rate. Check out page 5 of the Super additional information booklet for more.

- We recommend you speak with a financial adviser to determine if a salary sacrificing strategy makes sense for your personal circumstances.

- If you’re ready to salary sacrifice, you can complete this form and give it to your employer and they’ll take care of the rest for you.

You’ve consolidated your super accounts into Australian Ethical and you’ve told your employer to direct your contributions to it – good work! The next step is to have a think about your investment options.

If you don’t select your options when you join you will be placed in our MySuper option, which is our Balanced (accumulation) option. This option aims to achieve returns of 3.5% per annum above inflation and has a ‘medium to high’ risk level. You can find out more information about the fees and costs of the MySuper option (and all of our other options) in the Product disclosure statement and the Super additional information booklet.

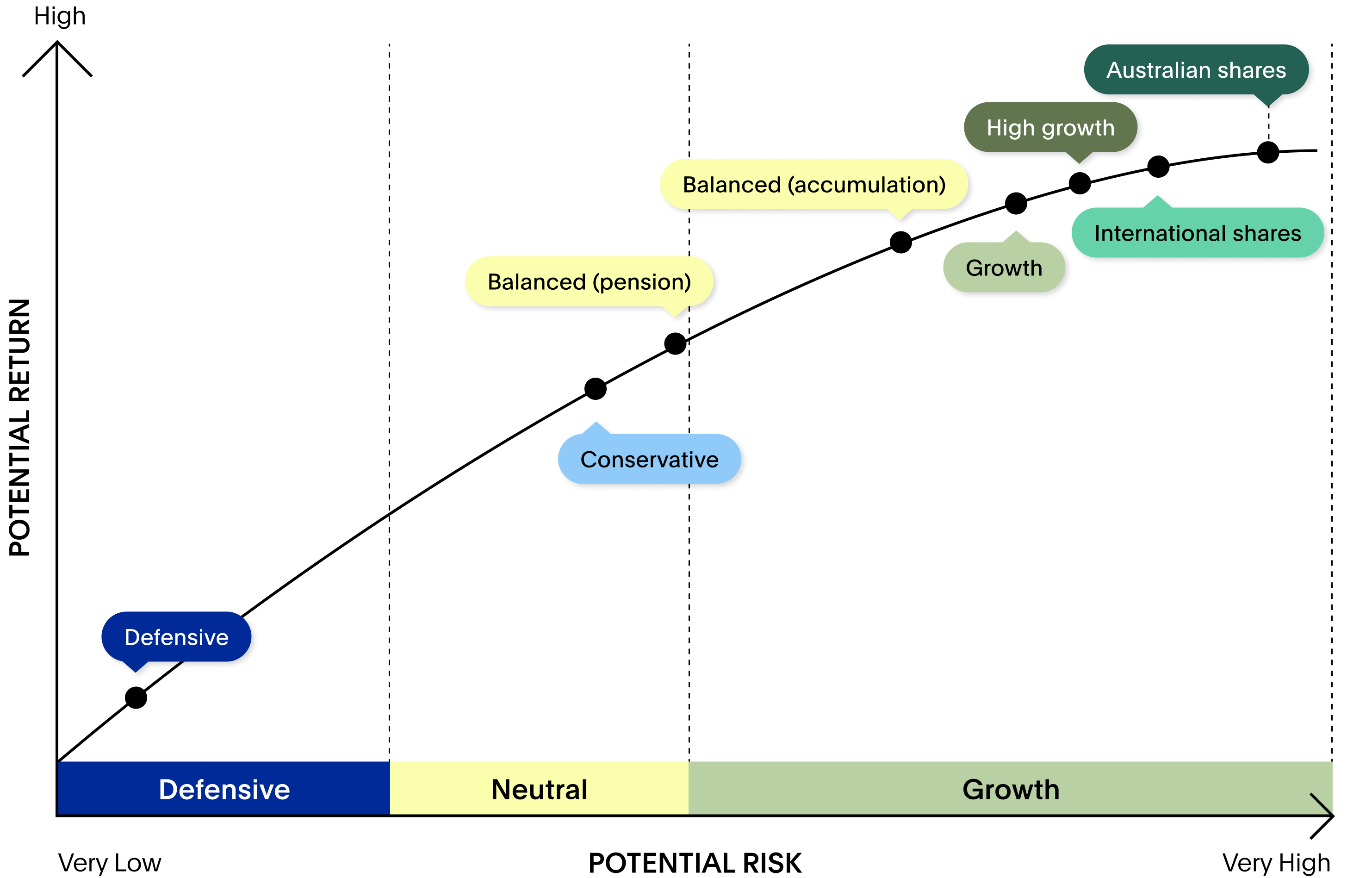

However, you are not limited to choosing the Balanced option. Your investment options can significantly impact how much money you can retire on so it’s worth thinking about their performance. There are a range of other investment options to choose from (see chart below) ranging from the Defensive and Conservative options all the way to the more aggressive International Shares and Australian Shares options.

Our main investment option, the balanced fund, returned 6.7% during the 5 years ending 31 October 2018 – beating its investment objective of 5.6%. The Australian Shares option returned 10.1% over the 5 years to 31 October 2018 and the Advocacy option returned 8.2% over the same period~. The Advocacy option invests in a mix of Australian and international shares that pass our ethical screening, and it also takes very small positions in companies that don’t meet our ethical requirements. These small or ‘nominal’ holdings allow us to advocate for change at shareholder meetings. You can read all about our different investment options (along with their fees and costs) in our Super additional information booklet.

We recommend you speak with a financial adviser before making any investment decisions.

See instructions to set investment options

~ Return of capital and the performance of your investment in the fund are not guaranteed. Past performance is not a reliable indicator of future performance.

The final piece of the ‘setting up your super’ puzzle is insurance and beneficiaries. If you want to understand the basics about insurance you can take a look at our Insurance Factsheet.

Our Insurance guide provides more detail about the different types of insurance offered through the fund and all the terms and conditions that apply. As insurance can be complex, we recommend you speak with a financial adviser about the different options and what is appropriate in your situation.

When you became a member of Australian Ethical you were most likely opted in to a minimum level of death and total and permanent disability (TPD) cover, which equates to three units of default Death and TPD cover. It’s up to you whether you want to increase this insurance or cancel it. You may decide you’d like to hold your insurance outside super instead. The important thing is that you have a suitable level of insurance for your current needs.

To check or manage your insurance, log into your Australian Ethical member portal and go to the Insurance section. This will take you to your Insurance portal where you can review your level of cover. The figures in the dashboard are a combined total of your super account balance and the insurance cover that you have for Death and/or TPD.

You should nominate beneficiaries to receive your super balance should you die (along with any insurance benefits). These nominations can be ‘binding’ or ‘non-binding’ – both options have their pros and cons and you’ll need to consider your own personal circumstances. More information about these types of nominations can be found under the Beneficiaries tab in the member portal. We recommend you speak with an estate planner and/or a financial adviser before making beneficiary decisions.

To nominate your beneficiaries, log into your Australian Ethical member portal.

Important information

See the forms and PDS page for important information like the Financial service guide, product disclosure statement, additional information booklet, insurance guide and more.