MySuper aims to provide low cost, simple and comparable superannuation products.

![]()

Balanced investment option

MySuper authorised product is the Australian Ethical Super Balanced (accumulation) investment option. This means if you’re a new or existing member and you haven’t made an investment choice; your money will be invested in this option.

This dashboard can be used to compare our MySuper product to other MySuper products based on cost, investment performance, and insurance.

Our Product Disclosure Statement and Super Additional Information Booklet provide more detailed information about the benefits and risks of investing in Australian Ethical Super. You should read these documents and the Target Market Determination and consider seeking professional financial advice before making a decision.

Overview

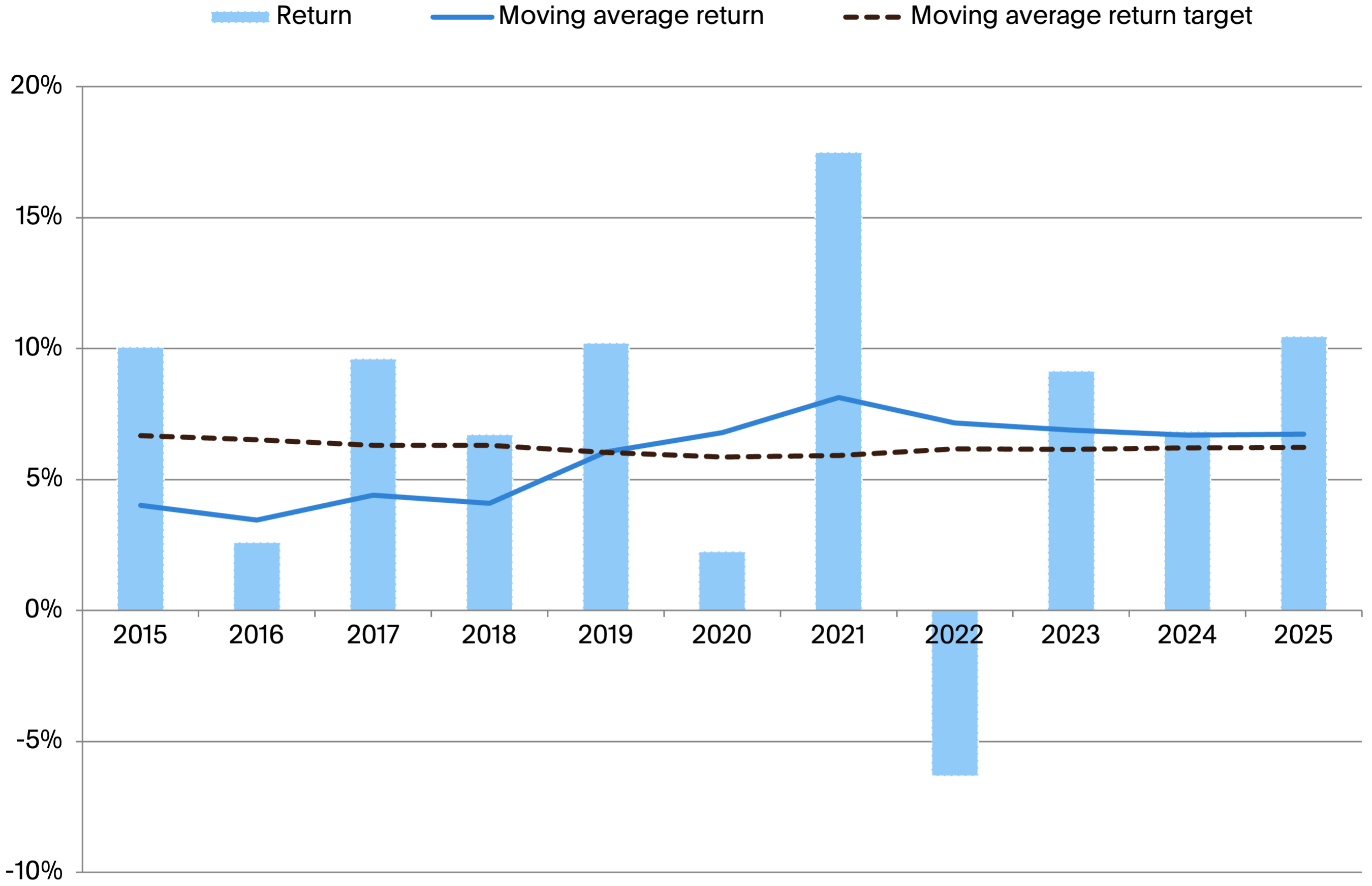

| Return1 |

10 year average return of 6.84% as at 30 June 2025. |

|---|---|

| Return target2 |

Average annual return of 3.25% above inflation over 10 years, after fees and taxes. |

| Level of investment risk3 |

Medium |

| Statement of fees and other costs4 |

$618 per year5 |

Comparison between return target and return6

For more information on how to compare MySuper investment options go to the Australian Securities and Investments Commission (ASIC) MoneySmart website (www.moneysmart.gov.au).

Important info

Returns and fees shown in the dashboard have been calculated using prescribed standard methods and assumptions. In particular, you should be aware that:

-

the standard calculations are based on a member with an account balance of $50,000, which will not be relevant to all members;

-

the standard calculations do not allow, for example, for the effect of investment earnings, contributions to your account, insurance fees or various other matters.

As a result:

-

the returns shown in the dashboard will be different from the returns shown on our website and in our Annual Report.

-

the returns and fees shown in the dashboard will be different from the amounts which apply to your account.

- Return is the average annual performance of the Balanced (accumulation) investment option over the previous ten financial years. It is the performance achieved for a representative member with a $50,000 balance, after administration and investment fees, taxes and other costs.

- Return target is the average annual return which the Balanced (accumulation) investment option aims to achieve above inflation over a 10 year period. It is a target only, and is not a guarantee of future performance. The measure of inflation is the Consumer Price Index (Trimmed mean) released by the Australian Bureau of Statistics on a quarterly basis.

- Level of investment risk is based on industry guidance and can be used to compare investment options that are expected to deliver a similar number of negative annual returns over any 20 year period. It is not a complete assessment of all forms of investment risk and does not take in to account the impact of administration fees and tax on the likelihood of a negative return, the size of potential positive and negative returns, or whether the likely returns will meet your individual needs. The level of risk is shown on a scale from Very Low to Very High. The “Medium to High” risk classification applies to funds with an estimated likelihood of “3 to less than 4” negative returns over any 20 year period.

- Statement of fees and other costs is the sum of administration, investment and advice fees for a representative member with a $50,000 balance that is wholly invested in the Balanced (accumulation) option. Activity fees, insurance fees, buy-sell spreads and exit fees may also apply. Where applicable, fees shown include GST. Fees are not guaranteed and may change in the future. Where a tax deduction is available to the Fund in relation to fees, this deduction is passed back to your account at the time of deducting the applicable fee. These tax deductions are not included in the Statement of Fees and Other Costs, so the net effect of the fees and costs may be less than the amount shown.

- Using the example of a $50,000 account, you will be charged each year an administration fee of $68, plus 0.25% p.a. of your account balance ($125), plus investment feeof 0.82% p.a. ($410) and transaction costs of 0.03% p.a. ($15). This brings the total cost to $618 per year.

-

The columns in the graph show the one-year net return of a representative member for each year to 30 June. The return is net of all investment management expenses, administration fees and taxes. It is important to remember that past performance is not an indicator or guarantee of future performance, and the value of investments can rise or fall. The dotted line shows the 10-year moving average net return of a representative member to 30 June of each year. The solid line shows the 10-year moving average return target to 30 June of each year.

Last updated 14 August 2025

Want to change your investment strategy?

Check out our investment options and make the switch through our member portal when you’re ready if you want to invest your super money differently.