General

commentary highlights

read more

Fund commentary

The Balanced (Wholesale) Fund delivered strong returns over medium term ending 30 June 2021, beating its benchmark over 1 and 3 years. This was driven by strong equity markets globally and stock selection in domestic equities, particularly in the healthcare and materials sectors.

The Fund’s Sharpe Ratio was higher than that of its benchmark, which tells us that the Fund took less risk to achieve the same return as the benchmark. This is a testament to Balanced Fund’s focus on delivering high returns while considering risk.

Balanced (Wholesale) Fund Performance as at 30 June 2021*

Source: FE fundinfo. Benchmark is the Australian Ethical Balanced Composite. Past performance is not a reliable indicator of future performance.

Balanced Fund (Retail) Performance as at 30 June 2021*

|

|

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

|

Fund |

18.3 |

9.7 |

8.5 |

8.3 |

7.0 |

|

Benchmark |

16.4 |

8.8 |

9.0 |

9.2 |

7.6 |

Source: FE fundinfo. Benchmark is the Australian Ethical Balanced Composite. Past performance is not a reliable indicator of future performance.

Relative to peers, both the Wholesale and Retail funds delivered first or second quartile returns over longer-term periods ending 30 June 2021. The performance of both funds ranked in the top spot over 3 years:

- the Balanced Fund (Retail) ranked in first place out of 36 funds in the Mercer Retail-Balanced Growth Universe

- the Balanced (Wholesale) Fund ranked in first place out of 47 funds in the Mercer Wholesale-Balance Growth Universe.

Quartile rankings as at 30 June^

|

|

1 Year |

2 Years |

3 Years |

5 Years |

10 Years |

|

Balanced (Wholesale) Fund |

3rd quartile |

1st quartile |

1st quartile |

n/a |

n/a |

|

Balanced Fund (Retail) |

3rd quartile |

1st quartile |

1st quartile |

2nd quartile |

1st quartile |

Source: MercerInsights as at 30 June 2021

Over the past year ending 30 June 2021, the fund placed in the third quartile of the Mercer universe of Balanced Growth Funds (both wholesale and retail). The Fund’s defensive allocations likely contributed to this result as they tend to be very defensive compared to peers. For example, fixed income assets held in the Fund had no exposure to high yield or other intermediate risk assets in a year that rewarded the largest exposures to risk assets. Balanced fund investors still received strong absolute returns over the past 12 months.

In addition to delivering solid returns to investors, the Balanced Fund helps create positive outcomes for people, planet and animals. The carbon footprint of our share investments is 75% less than traditional share investments1.

1Carbon intensity (tonnes CO2e per $ revenue) of Australia Ethical share investments compared to blended benchmark of S&P ASX 200 Index (for Australian and NZ shareholdings) and MSCI World ex Australia Index (for international shareholdings). Shareholdings as at 31 December 2019.

Contributors

Domestic equities were the key driver of relative and absolute performance, returning 38% against the benchmark S&P ASX 200 return of 28% driven by stock selection, particularly in the healthcare and materials sectors. Two standout performers for the fund were Pilbara and Orocobre (ASX:PLS and ASX:ORE), returning 522.6% and 180.1% respectively. These stocks form part of the materials sector, which Australian Ethical is traditionally underweight due to our Ethical Charter. Refer to the break-out box for more information on why we hold these stocks in our portfolio.

International equities also generated positive absolute and relative performance, returning 29.6% against the benchmark MSCI World Index Ex AU return of 27.5%. This was driven by an underweight position to consumer staples and healthcare which both underperformed. The portfolio also benefited from stock selection in the healthcare sector.

Property portfolio also outperformed, with our healthcare property holdings demonstrating resilience through the Covid pandemic, attracting increased institutional interest .

Detractors

The Balanced Fund Australian equities allocation is underweight banks which rebounded significantly through FY21 as the economy recovered, default rates were lower than expected, and activity in the housing markets increased. The major banks each returned each returning in excess of 48% over the financial year and comprise 19.7% of the benchmark. While the Fund holds Westpac and NAB, the Fund is currently underweight the benchmark in both these positions and does not hold CBA nor ANZ as they do not meet the Australian Ethical Charter.

Alternative investments

During the past 12 months, the Balanced fund increased its holdings in alternative assets, which we do by investing in other funds, rather than direct investment, allowing us to tap into specialist capabilities when required.

For example, we invested in the CSIRO Innovation Fund managed by Main Sequence Ventures. The Fund has a deep tech thematic that is well aligned with our purpose and offers a diversified exposure to our venture capital portfolio. The relationship with the CSIRO also provides a unique competitive advantage, giving the fund access to companies and technologies coming out of the organisation, as well as the considerable resources and ‘brains trust’ of the CSIRO.

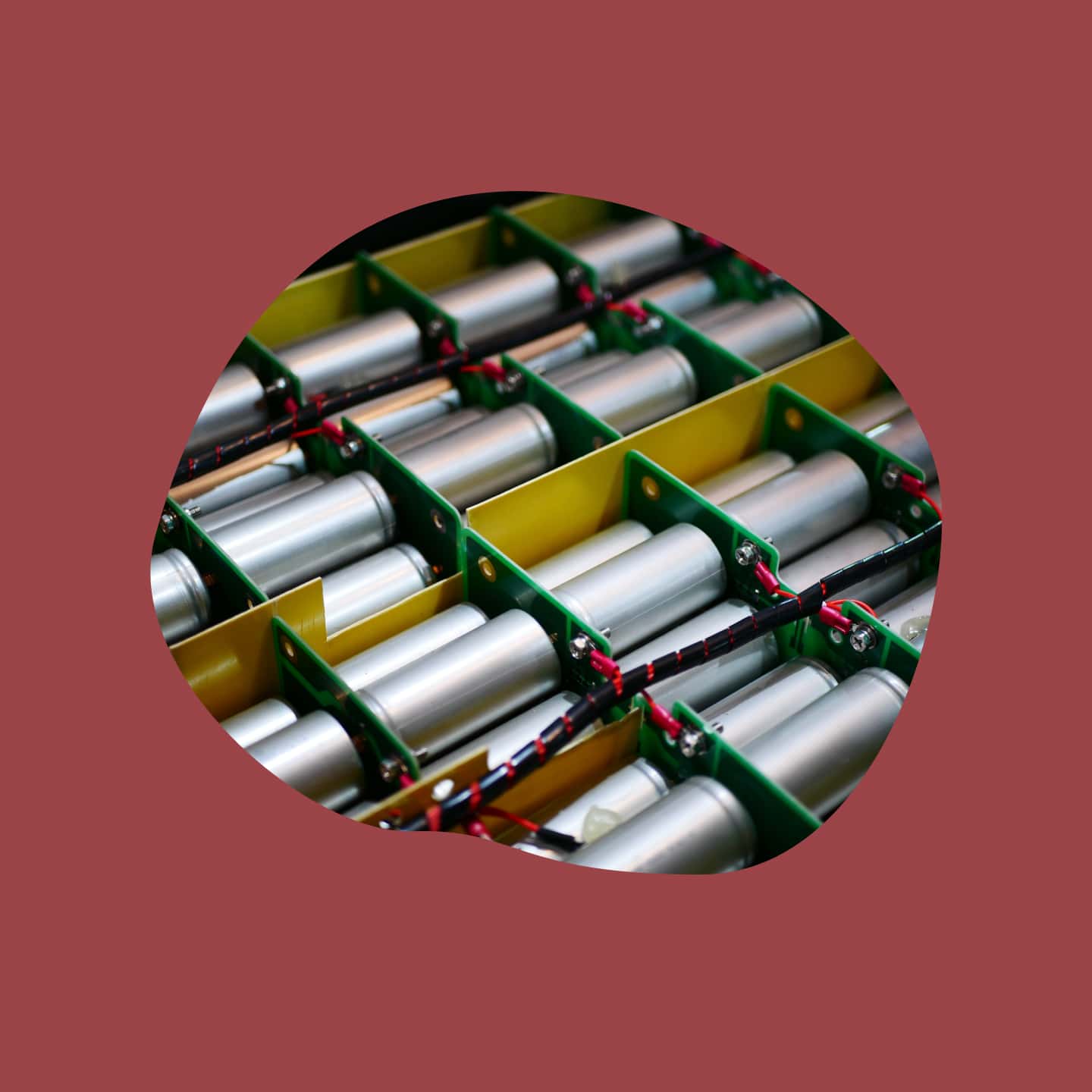

Investing in the transition to renewables

Pilbara and Orocobre (ASX:PLS and ASX:ORE) are lithium miners that sit within the material sector of the Australian share market. The application of our Ethical Charter, that seeks out positive companies and avoids those doing harm, means we are significantly underweight the materials sector in Australia. However, lithium is crucial for the transition to renewables.

Both Pilbara and Orocobre, benefited from a recovery in the price of raw materials for lithium. Sentiment has also been highly positive as investors anticipate strong demand to come from the growing electric vehicle market. A strong balance sheet enabled Pilbara to navigate through a period of weak market conditions and emerge as one of the biggest spodumene producers in the market after acquiring the neighbouring Altura Mining assets during the downturn.

Fund strategy

The Balanced Fund offers investors an exposure to a broadly diversified portfolio across asset classes, utilising Australian Ethical specialist capabilities in listed equities and domestic fixed income. The Balanced Fund is positioned in a majority of growth assets, in line with its long-term strategic asset allocation.

Past performance is not a reliable indicator of future performance. Australian Ethical offers a diverse range of investment options depending on your investment objective, timeframe and risk profile. You can see the options and their respective performance here.

*Total returns are calculated using the sell (exit) price, net of management fees and gross of tax as if distributions of income have been reinvested at the actual distribution reinvestment price. The actual returns received by an investor will depend on the timing, buy and exit prices of individual transactions. Return of capital and the performance of your investment in the fund are not guaranteed. Past performance is not a reliable indicator of future performance. Figures showing a period of less than one year have not been adjusted to show an annual total return. Figures for periods of greater than one year are on a per annum compound basis. The current benchmark may not have been the benchmark over all periods shown in the above chart and tables. The calculation of the benchmark performance links the performance of previous benchmarks and the current benchmark over the relevant time periods.

^According to the Mercer Investment Performance Survey of Wholesale-Balanced Growth (Actual Ranking) and the Mercer Investment Performance Survey of Retail-Balanced Growth (Actual Ranking) as at 30 June 2021. Information sourced from MercerInsights has been obtained from a range of third party sources. While the information is believed to be reliable, Mercer has not sought to verify it independently. As such, Mercer makes no representations or warranties as to the accuracy of the information presented and takes no responsibility or liability (including for indirect, consequential or incidental damages), for any error, omission or inaccuracy in the data supplied by any third party.

This commentary may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Australian Ethical accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.

EOFY Updates >