The role of battery technology in the energy transition

There’s more to the energy transition than generating as much wind and solar energy as possible and pumping it into our grids and homes.

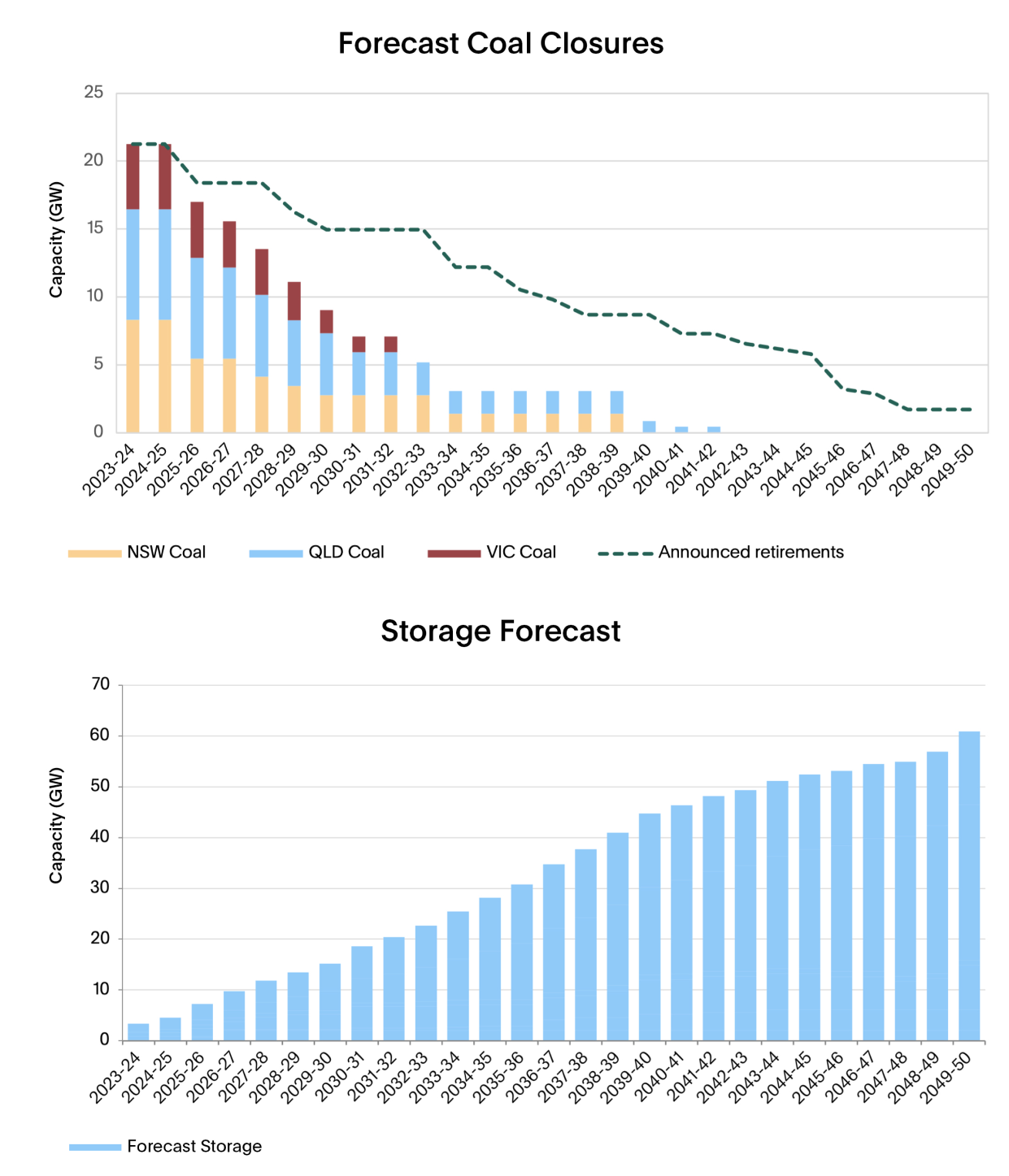

To more than double the amount of renewable energy consistently used in our energy mix and reach our goal of 82% renewable energy by 20301, it will require a transformation of our grids, and significant advancements in storage technology.

For coal plants to close, and for us to bring our emissions down to align with Paris Agreement targets, the grid first needs replacement dispatchable capacity.

Wind and solar will deliver the bulk of energy supply, but giving up our stable baseload also means losing grid stability and around the clock energy as Australia decarbonises.

Source: AEMO Integrated Systems Plan 2022 - Chart Data

Batteries allow the grid to absorb the inherent variability of renewable energy generation, providing access to electricity at times of peak demand, even if these periods don’t correspond to peak generation from solar or wind.

But the pathway to a renewable-powered energy grid won’t be a straight line, and there will be different capital demands at different times as this technology develops.

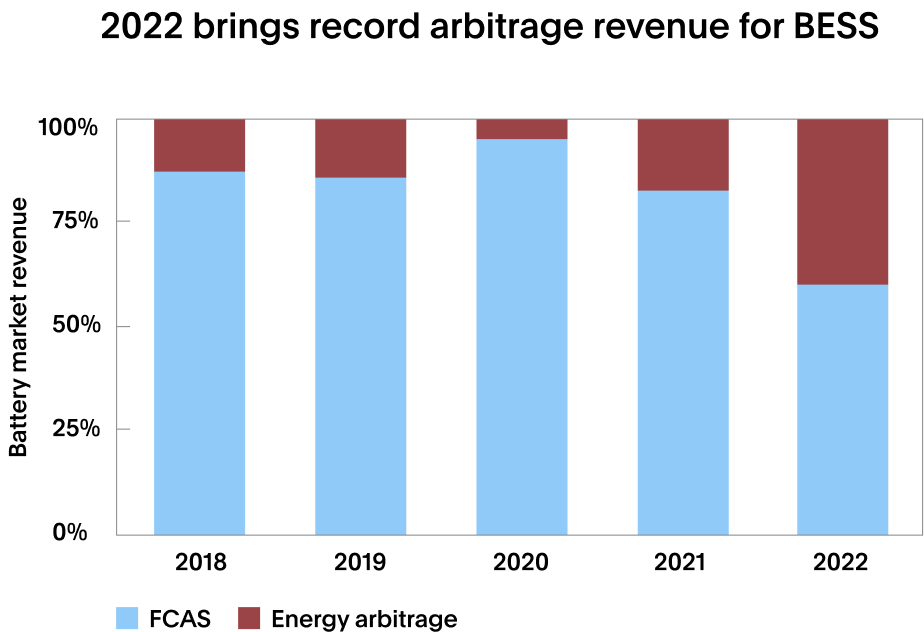

Stability now, arbitrage later

Battery operators today generate most of their revenues by providing ancillary services to grids, which gives helps to smooth energy distribution and avoid blackouts.

Over time, the revenue mix for battery providers is more likely to be dominated by buying electricity cheaply at times when there’s excess, and then dispatching it when it is expensive during peak periods in the evening when there is low generation but high demand.

The so-called Frequency Control Ancillary Services (‘FCAS’) revenues are currently a large share of total merchant battery revenue operators earn today – these are payments made by Australian Energy Market Operator to FCAS providers through an auction process.

The main job of batteries today is to ensure electricity generation doesn’t stay too far from electricity consumption to avoid blackouts.

The increasing penetration of renewable power generation and its variable generation has meant that the risk of instability has increased.

AEMO calculates the risk of contingency events on an ongoing basis, and this changes the amount of FCAS they procure from privately owned batteries.

Therefore, most FCAS revenue is earned when AEMO is most nervous about the risk of an event occurring, with FCAS prices varying from 1 cent per MWh to greater than $15,000 per MWh.

Early large-scale batteries are well placed to capture the benefit from potentially higher near-term FCAS revenues – this makes the opportunity compelling today for both debt and equity investors.

The role of debt

Unlike utility scale wind and solar projects, there isn’t a well-established private sector project finance debt market for utility scale batteries in Australia. This is particularly the case for merchant batteries because they’re earning revenue from trading activities, rather than being underpinned by utility or government availability payments.

There is a lack of competition for debt finance for merchant batteries due to structural funding constraints of traditional project financers. This lack of competition in the debt finance market provides an opportunity to lock in attractive long-term debt margins by being a first mover in the merchant battery debt finance space.

For merchant battery projects, we believe debt offers a compelling risk adjusted investment return profile compared to equity. Debt cash flows are front ended, with returns driven by the project revenues in the early years of the project life. By contrast, equity returns are back ended and, hence, exposed to long-term technological progress/battery cost deflation.

Hornsdale power reserve

The South Australian Hornsdale Power Reserve operated by Neon Capital Battery shows how important FCAS revenue can be to a battery/storage project.

Phase 1 (100MWh) was completed in 2017 and Phase 2 (50MWh) in 2020 for a total construction cost of A$171 million. The battery has a 10-year contract with the South Australian Government to provide reserve capacity of 70MW and 29 MWh for AEMO to deploy when required. The availability revenue from the South Australian Government is A$41.8 million (over 10 years).

Source: Energy Synapse Platform

Over the period to July 2022, Hornsdale has also earned merchant FCAS and energy trading revenues of A$132 million on the capacity it does not have to reserve for the South Australian Government. The Hornsdale Power Reserve has already paid back its total construction cost with a further 15-plus years of operations ahead.

1 https://www.dcceew.gov.au/sites/default/files/documents/annual-climate-change-statement-2023.pdf

Interests in the Australian Ethical Managed Funds are issued by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949), the Responsible Entity of the Australian Ethical Managed Funds.

The information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Certain statements in this document relate to the future. Such statements involve known and unknown risks and uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from expected future results. Australian Ethical Investment Ltd does not give any representation, assurance or guarantee that the events expressed or implied in any forward looking statements in this update will actually occur and you are cautioned not to place undue reliance on such statements.

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.