The energy transition – making the most of the opportunity

There’s been some big numbers thrown around about amount of capital required to fund Australia’s transition to more renewable energy sources over the next two-decades and beyond.

Global investment in clean energy rose to an all-time high of USD $1.7 trillion in 2023. The biggest spend is on solar energy, which has drawn on investment of USD $380 billion1.

In Australia alone, $33 billion has already been spent to get this far, adding 8GW of solar, 11GW of wind and 1.5GW of battery storage to the grid. This compares to the 23GW of dispatchable firm capacity from coal-fired generation2.

To get to where we need to go, the Australian Energy Market Operator reckons we’ll need to more than double this spend in the next 6 years (an additional $80 billion this decade3) to get to 82% renewables in our energy mix.

Working back from our commitment under the Paris Agreement to limit the planet’s warming to 1.5 degrees, it’s clear we need to pick up the pace of emissions reductions. The Australian Government has legislated targets of a 43% reduction in emissions by 2030 from 2005 levels. To reach these targets Australia will need to decarbonise quicker than its current annual rate of around 17 megatonnes CO2-e4.

![]()

Source: Climate Change Authority using historical data from the unpublished June 2022 Greenhouse Gas Inventory Quarterly Update.

Latest measurements show that 39% of all energy generation sent out via the National Electricity Market was from renewable energy sources, including solar, wind and hydro5. Indeed, renewable energy generation capacity has been rapidly increasing in recent years, more than doubling in the last decade, largely driven by solar.

But we can’t just switch off coal and gas and switch on renewable energy generated by wind, solar and water overnight.

We’re shifting away from coal and gas in the least costly and disruptive way possible, but it’s not going to be easy.

Mining of hydrocarbons has been pivotal to our standard of living to date. Detaching ourselves from this historically reliable and accessible source of energy in the short amount of time we’ve set ourselves will surely be disruptive. Investors need to consider a new set of risks and opportunities to be well positioned.

Equity vs. debt

The opportunity for investors to fund the renewable energy transition is immense, but getting capital to where it’s needed the most at the right time with appropriate risk and return characteristics hasn’t always been straight forward.

Investing in listed companies with exposure to renewable energy might be an obvious way for individual investors to tap into the mega-trend, but infrastructure equity will only suit some investors.

In the absence of ‘pure play’ listed renewables energy stocks, investors looking for exposure to this area might be settling for more integrated businesses with traditional energy exposure.

These risks are not necessarily dealbreakers for investors, but they won’t suit everyone.

In return for the risk they take, equity investors will receive a disproportionate share of the upside in performance of the underlying infrastructure business.

To achieve these equity-style returns, however, investors need to invest for a long time. In contract, debt largely gets amortised first – which means the equity returns are largely back-ended and more subject to longer term energy price movements.

Equity market valuations also bake in decades of future growth expectations, which is an important consideration when thinking about areas such as renewable energy where technological innovation could lead to leapfrogging, and leaders could turn into laggards.

Debt tends to offer lower returns on average. While debt doesn’t participate in the upside of underlying infrastructure asset, it’s less risky, and has shorter investment time horizons, with terms to maturity of typically 3-7 years.

Private markets and the energy transition

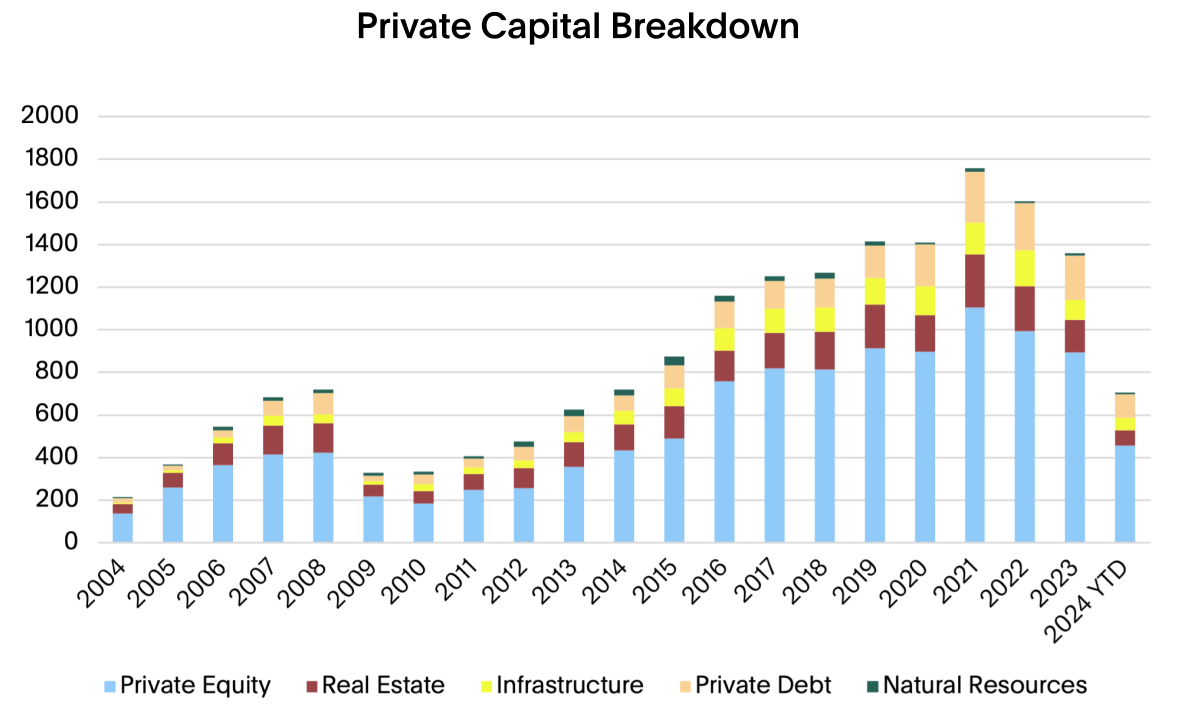

Private capital has played an important role in infrastructure funding for some time, particularly private equity, which has accounted for the largest proportion of private funding sources to date.

Private debt has been the fastest growing asset class for some time and is projected to become the second-largest private capital asset class next to private equity, according to the Preqin6.

In fact, while global listed equities and Australian bonds have doubled in size over the last 10 years, the amount private debt has raised has almost tripled in that timeframe, Preqin figures show.

This shift in investor perception and use for private debt has been driven by a number of factors, including increasing awareness of this style of investing within the investor community on the demand side, as well as the absence of banks opening up more opportunities for projects to be funded by private lenders on the supply side7.

Just as infrastructure equity has listed and unlisted forms, different types of infrastructure debt – loans versus publicly traded bonds – have differing levels of liquidity and, hence, illiquidity premia.

When comparing public and private market equity, investors may typically think about the advantages that come with harvesting the illiquidity premium. But when it comes to comparing private equity to private debt, the story becomes more about the comparison of downside risk and cash flow certainty.

Debt will generally offer lower returns on average but will be less risky.

Which is the better investment will depend on relative pricing as well as the time horizon and risk appetite of investors.

1 International Energy Agency’s World Investment 2023 Report

2 Integrated System Plan, AEMO 2022

3 https://www.dcceew.gov.au/sites/default/files/documents/annual-climate-change-statement-2023.pdf

4 2023 Annual Progress Report (climatechangeauthority.gov.au)

6 https://www.preqin.com/insights/global-reports/2022-preqin-global-private-debt-report

7 Briefing note - Energising Australia's green bank.pdf (ieefa.org) P5

Interests in the Australian Ethical Managed Funds are issued by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949), the Responsible Entity of the Australian Ethical Managed Funds.

The information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Certain statements in this document relate to the future. Such statements involve known and unknown risks and uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from expected future results. Australian Ethical Investment Ltd does not give any representation, assurance or guarantee that the events expressed or implied in any forward looking statements in this update will actually occur and you are cautioned not to place undue reliance on such statements.

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.