Sustainable infrastructure debt – what it is & how it works

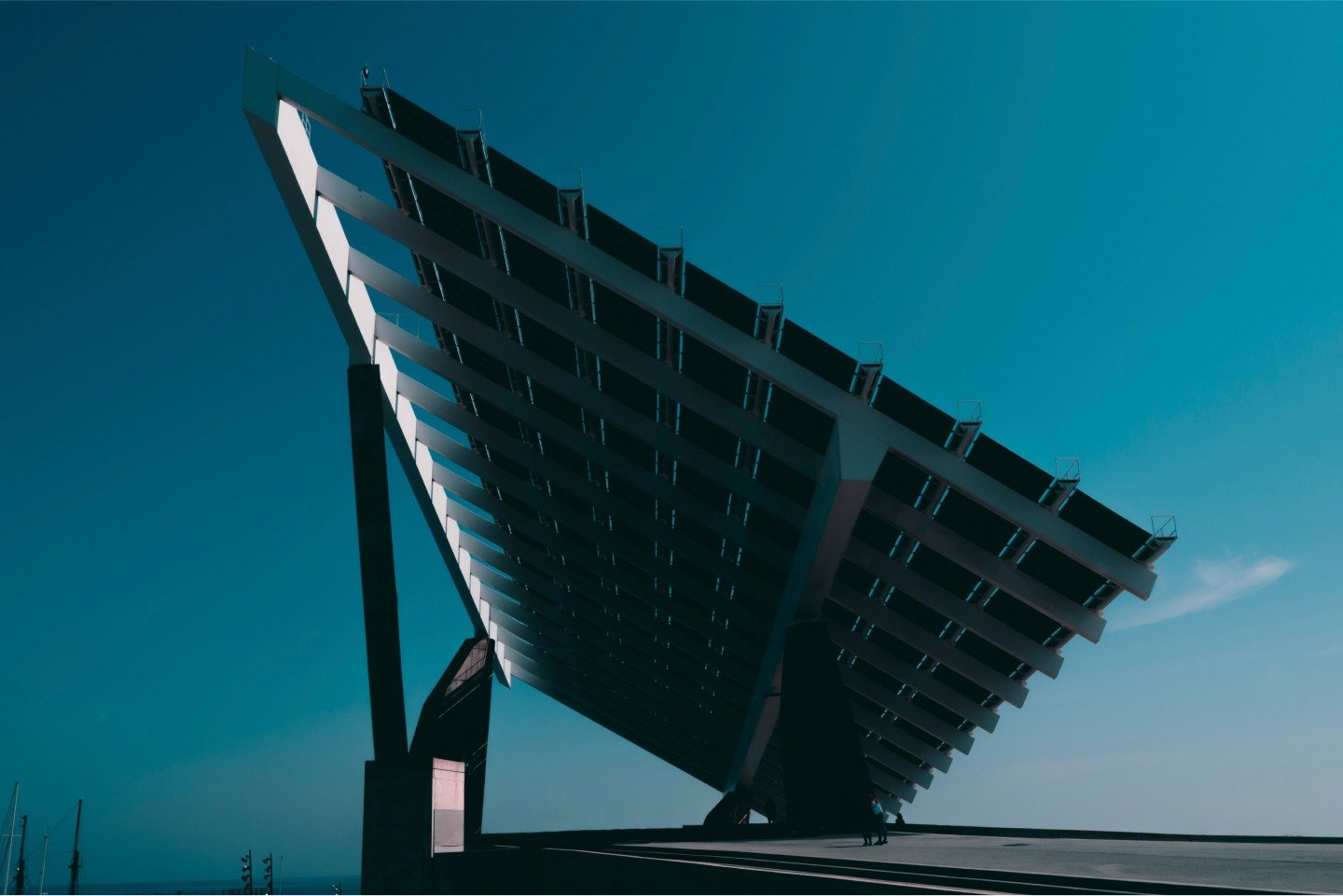

Sustainable infrastructure projects are popping up all over Australia – transforming the way our energy is generated, where people live and how we access essential services.

Read about the scale and expected speed of the energy transition here.

And while demand for new project financing is clear, the characteristics of these projects and how they come together to generate returns for investors might be potentially less well known.

Unique characteristics

Each type of sustainable infrastructure project brings unique characteristics and diverse return profiles.

Utility-scale wind and solar farms generate revenue through power purchase agreements (PPAs), or directly as part of a merchant arrangement. PPAs are agreements where utilities or other off takers agree to buy the electricity generated at a fixed price, while the merchant model involves the direct ownership of the power generation.

Battery storage attached to solar projects, meanwhile, will enhance a project’s flexibility and revenue potential, allowing energy storage for later use or sale back during peak demand periods.

On their own, batteries will derive revenues by dispatching energy when it’s expensive during peak periods in the evening when there is low generation but high demand. For now, at least, batteries tend to make most of their revenues through payments made by Australian Energy Market Operator for providing stability to the system.

Read about the role batteries will play in the energy transition here.

Social infrastructure, social housing and environmental property projects benefit from government funding and align with our purpose under our Ethical Charter. These types of projects are aligned with Sustainable Development Goals set by the United Nations. SDG 11 relates to sustainable cities and communities, while SDG 4 and 13 relating to quality education and climate action.

Social infrastructure typically includes projects with government availability payments that involve infrastructure like schools, hospitals or government buildings. Similar to renewable energy projects, debt financing covers construction costs, with repayments and returns coming from government contracts, providing a relatively low-risk investment opportunity.

Social housing revenues, meanwhile, will come from rental income or government subsidies aimed at providing housing to low-income families or individuals. Returns for investors are derived from rental income, government subsidies, or the potential appreciation of property value over time.

Environmental property projects are projects focused on environmental conservation or sustainability efforts such as land preservation, reforestation or sustainable agriculture as well as energy efficiency improvements. Returns from environmental property projects include revenue generated from eco-tourism, carbon offset credits or grants and subsidies aimed at environmental conservation.

What is Infrastructure debt?

Infrastructure debt serves as an important financing tool for operating, maintaining and developing essential infrastructure assets.

Infrastructure is defined by all the characteristics we already know and love – they tend to provide essential services, stable cash flow generation, and high barriers to entry operating in monopolistic or quasi-monopolistic environments with inflation-linked returns.

Debt for renewable energy projects focuses specifically on renewable energy infrastructure including solar, wind, hydro and Geothermal power generation.

The way it works is a Special Purpose Vehicle (SPV) gets set up specifically to finance a particular project – kind of like giving the project its own identity. Debt sourced via this structure is not tied to a corporation’s overall finances, it’s linked solely to the success for that project.

The revenue generated by the project – like electricity sales from a wind farm – goes straight back to paying the debt, with excess cash flows going to equity holders.

Holders of the debt are in a privileged position because they have a priority claim over the cashflows; they’re also ‘owners’ of the asset which means they can recoup losses if defaults occur. If there are any hiccups or stumbles along the way, lenders are less likely to be affected because the debt amount tends to be less than the total amount of the asset.

Interests in the Australian Ethical Managed Funds are issued by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949), the Responsible Entity of the Australian Ethical Managed Funds.

The information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Certain statements in this document relate to the future. Such statements involve known and unknown risks and uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from expected future results. Australian Ethical Investment Ltd does not give any representation, assurance or guarantee that the events expressed or implied in any forward looking statements in this update will actually occur and you are cautioned not to place undue reliance on such statements.

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.