US President Donald Trump’s gift to ethical investing

For most ethical investors, “drill baby drill”, the dismantling of Diversity Equity & Inclusion programs, and reversal of the plastic straw ban, are initial actions that seem to have turned back 20 years of sustainable policy advancements.

As an ethical investor we are also concerned; we’re committed to leveraging our investor position to positively influence on systemic issues – these are issues that can impact the stability of the broader financial system. For example, the financial system is dependent on the level of climate stability and social cohesion.

But we think that concern about the returns from ethical investing may not be something to worry about. And, when there are returns, the money flows, making this an unstoppable force for sustainable growth and positive change.

John Woods, Australian Ethical Deputy Chief Investment Officer and Head of Multi Asset shares his views on investment markets with the arrival of US President Donald Trump – and it might not be what you expect.

What effect do you think the new US administration will have on your way of ethical investing?

Some of the new US President’s policies, like expanding fossil fuel extraction, banning offshore wind, and leaving the Paris Agreement, all go against scientific evidence.

Climate change is a major threat to the planet's health, which everyone’s ethical and financial goals depend on. But if you consider the role capital can play in bringing down emissions and addressing the climate emergency, you begin to see the next four years as more of an opportunity than a threat.

The short-term disruption brings more volatility to markets, which suits our style of investing. But over the medium and longer term, the US turning its back on climate creates a better entry point investors like us to find the innovations and technologies likely to make the most difference to where we need to be heading. It might seem counterintuitive to many people, but we expect some of the decisions being made today to benefit the returns our investors will gain over the long term.

Far from playing down the state of global politics and investment markets, John Woods sees opportunity ahead.

Why does volatility suit your style of investing?

We are active investors – we pick stocks and focus on buying assets at the right price. So this focus on rebooting the US fossil fuel industry means that companies supporting the renewable energy sector have seen their valuations reduced. Whilst we have always been heavily invested in renewables, we have made new investments in recent weeks and months we might not have been able to justify before, deepening our position in these areas.

By making decisions on climate, renewable energy and prolonging traditional energy sources in the United States, the new US President is disrupting our world, a world we have been investing in line with a consistent Ethical Charter for almost 40 years. This disruption is deeply concerning, but ironically creates opportunities to invest for us. Previously, too much capital was chasing some assets, making them expensive.

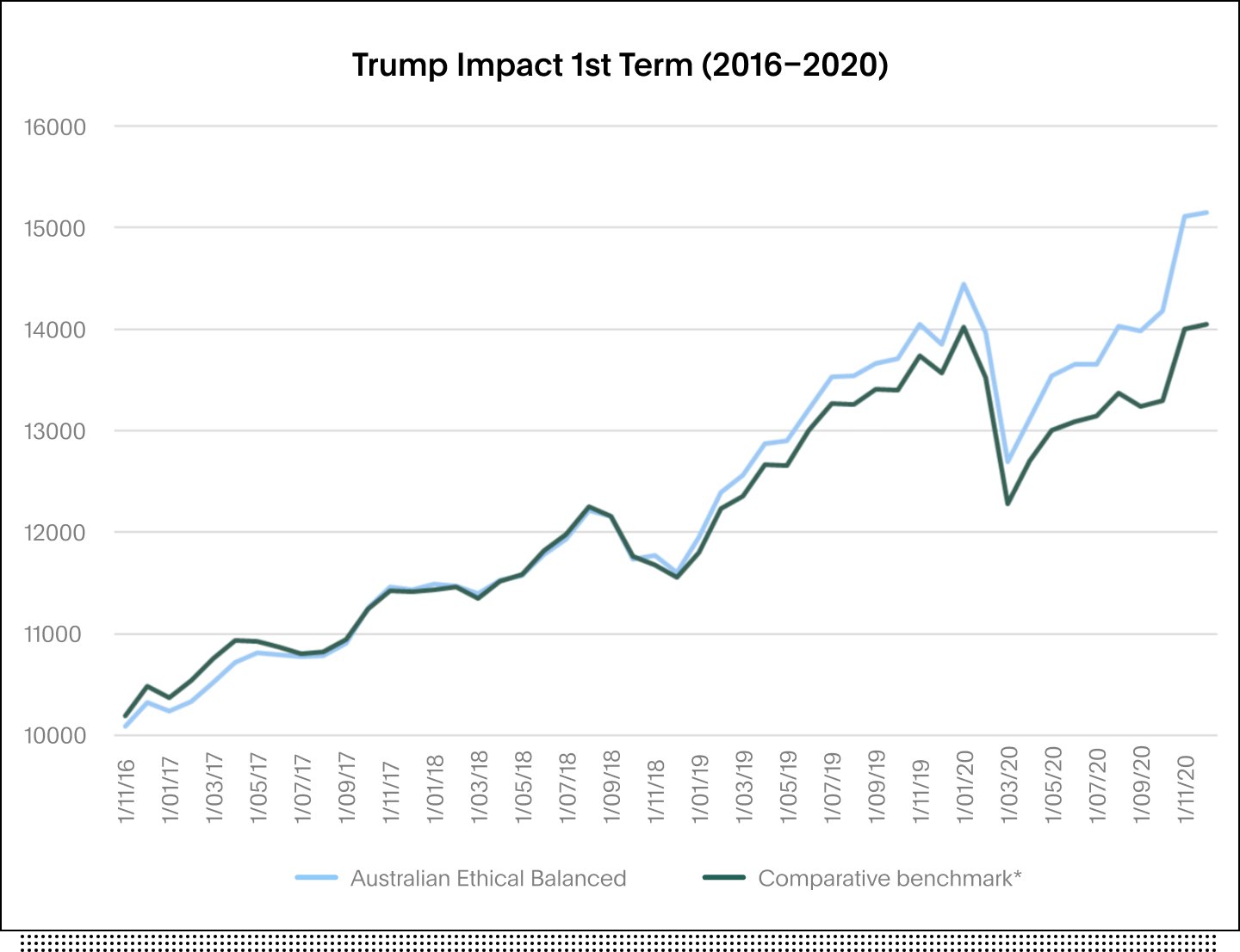

We also have history navigating his leadership before – if you look back to his last term [between 2016 and 2020] our main superannuation (Balanced) fund outperformed its objectives by more than 3 per cent [per annum] during that period. Our active approach means we can adapt to short-term changes if we believe they are longer term opportunities. This is something we are doing today.

I think this period will prove to be one of the best opportunities for ethical investors like us, not just because of the shift in political ideology, but also because of where we are in the context of this mega trend shift to cheaper renewable energy to address the climate emergency.

* The market benchmarks weighted by the Strategic Asset Allocation

Can you be specific about the opportunities you are taking advantage of?

Copper is one. Copper is an important component of renewable energy technologies and something we will invest in when valuations are attractive, although we acknowledge the challenges associated with sustainable production labelling, an area our ethics team is watching closely. We also invested in global climate-themed investments, including in US-listed First Solar and Enphase Energy, both share prices are down around 25% since the announcement of the election result on November 5, 2024.

We also made a new investment this year in a renewable energy-powered data centre in the US. Not so Trump related, but we obviously like the thematic driven by demand for AI and the search for cheaper energy. We know these markets and investments well and have a long-term investing thesis, allowing us to identify short-term opportunities.

If you invest for more than four years and believe in the long-term trend of cheaper, cleaner renewable energy, there is likely upside in today's prices. This means better returns for us. Genuine sustainable investors focused on this area should theoretically have an edge in this market.

Copper is an important component of renewable energy technologies.

How has your portfolio performed recently – if climate-related investments are repricing, does that mean your short-term returns are lower?

No, because we have been able to take advantage of increased volatility in markets. This has helped with our listed equities and currency positions. Our Balanced and High Growth superannuation options have outperformed their target returns by 3% and 4% respectfully in the 3 months to the end of January. These returns underpin the long-term outperformance of these options.

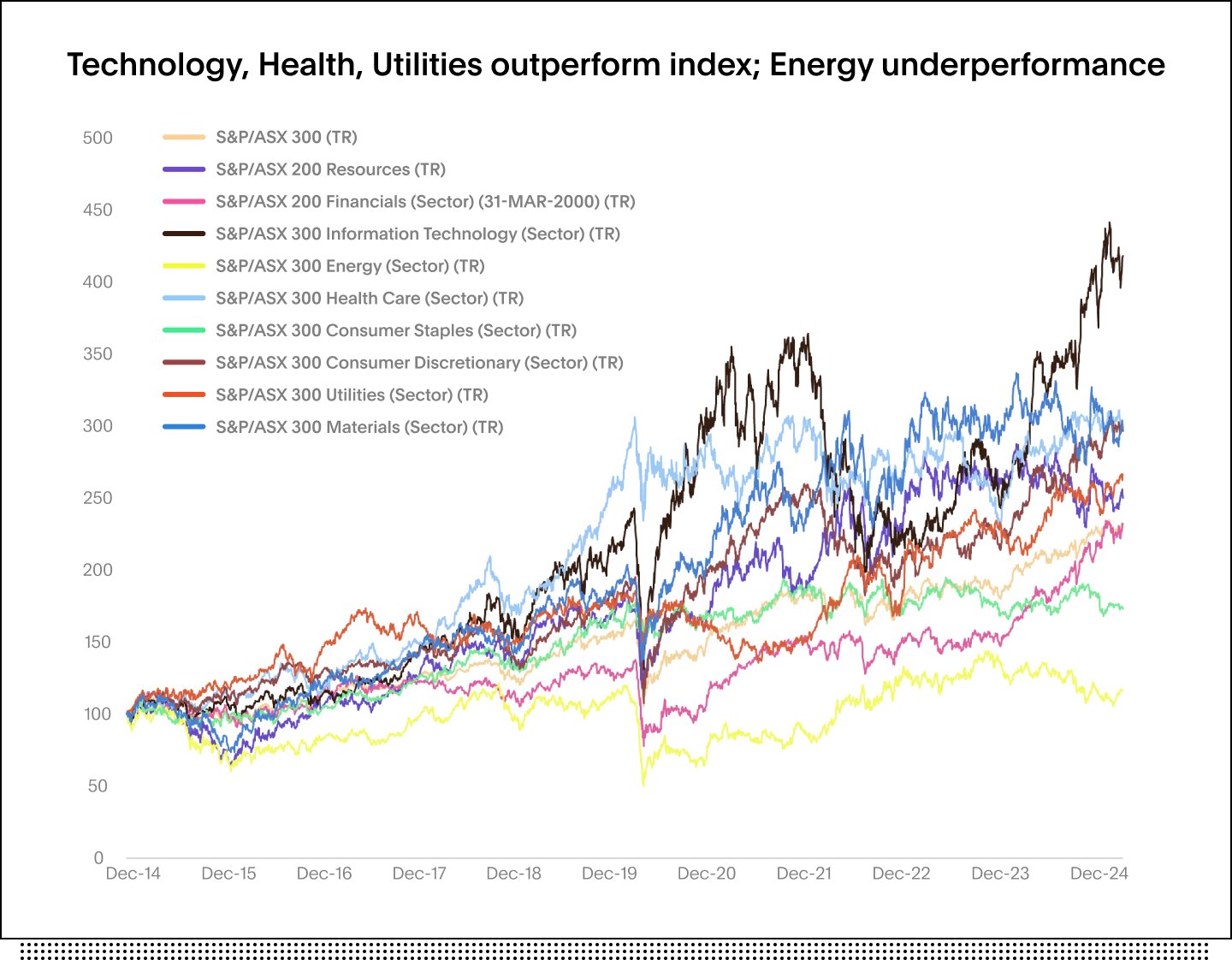

Tariffs on trade have been a positive for our future-focused portfolios. The economic slowdown playing out in China in recent years – compounded by the US’s trade tariffs – has seen our local resources and energy sectors underperform, an area we restrict investment in due to the emissions profiles of large coal and iron ore exporting companies. This is a sector we see continuing decline as economies shift to cheaper energy sources.

What is your view on China taking over from the United States as a renewable energy superpower, and what does that mean for your portfolios?

You want the US and China to be heading in the same direction for the good of the planet. That said, US President Trump’s regressive policies towards climate do leave space for other regions like Europe, like Asia, to step in and lean more heavily into 2050 net zero ambitions. I see a broader-based China recovery – which could involve supplying the world with the tools to source cheaper renewable energy.

This is a growth and returns opportunity for the industries and companies our Ethical Charter focuses us in on, such as miners of critical minerals. We see an opportunity now with companies sold off to invest in minerals like lithium and copper, which we believe are exposed to this slightly different Chinese economic growth story.

Do you think that this current political and economic period will be a positive for ethical investors?

I think this period will prove to be one of the best opportunities for ethical investors like us, not just because of the shift in political ideology, but also because of where we are in the context of this mega trend shift to cheaper renewable energy to address the climate emergency.

US President Donald Trump’s regressive energy policy is a negative for the environment, but the potential removal of government capital leaves room for private capital like ours – smart money – to find its way into the technologies and innovation that we think will form the basis of the new energy paradigm, but at potentially more attractive prices.

US President Donald Trump’s policies do not change the fact that the world is warming up. We live in a world where there are more frequent weather events and catastrophes, and that drives people to make solutions which need capital to get up and running.

If you consider the role capital can play in bringing down emissions and addressing the climate emergency, you begin to see the next four years more of an opportunity than a threat.

What is the biggest challenge for ethical investing (if it is not US President Donald Trump)?

The biggest challenge for ethical investing is distributing capital in the right places to be able to slow down the climate crisis and address other pressing issues. Despite the significant figures being discussed—Morgan Stanley recently estimated that achieving net zero greenhouse gas emissions by 2050 will require $US50 trillion in investment—I believe it is feasible through the compounding effects of returns and reinvestment.

If you consider all the capital that has gone into funding oil, it is likely only a portion was initial or new capital, with the majority recycled through profits and investment returns. To get the $US50 trillion dollars, you need to invest $US500 billion dollars a year, and earn a five or six percent return each year, and keep reinvesting it. It sounds daunting, but it is not. The biggest challenge for investors is to not destroy capital along the way, so we need to be making the smart investments and avoid overpaying to get the best returns. If we can invest sensibly, we will have the money to reinvest, and those targets will be achievable. This is central to our vision where money can be a powerful force for good.

Interests in the Australian Ethical Retail Superannuation Fund (ABN 49 633 667 743, USI AET0100AU) are offered by Australian Ethical Investment Limited (ABN 47 003 188 930, AFSL 229949) and issued by the Trustee of the Fund, Australian Ethical Superannuation Pty Limited (ABN 43 079 259 733, RSE L0001441, ASFL 526 055).

The information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Ratings or investment returns are only one factor you should consider when deciding how to invest. Remember, superannuation is generally a long-term investment. For details on the risks and fees of investing in Australian Ethical Super, please refer to the Financial Services Guide and Product Disclosure Statements on australianethical.com.au

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.

This commentary may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Australian Ethical accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.