Stay the course: Navigating market movements with confidence

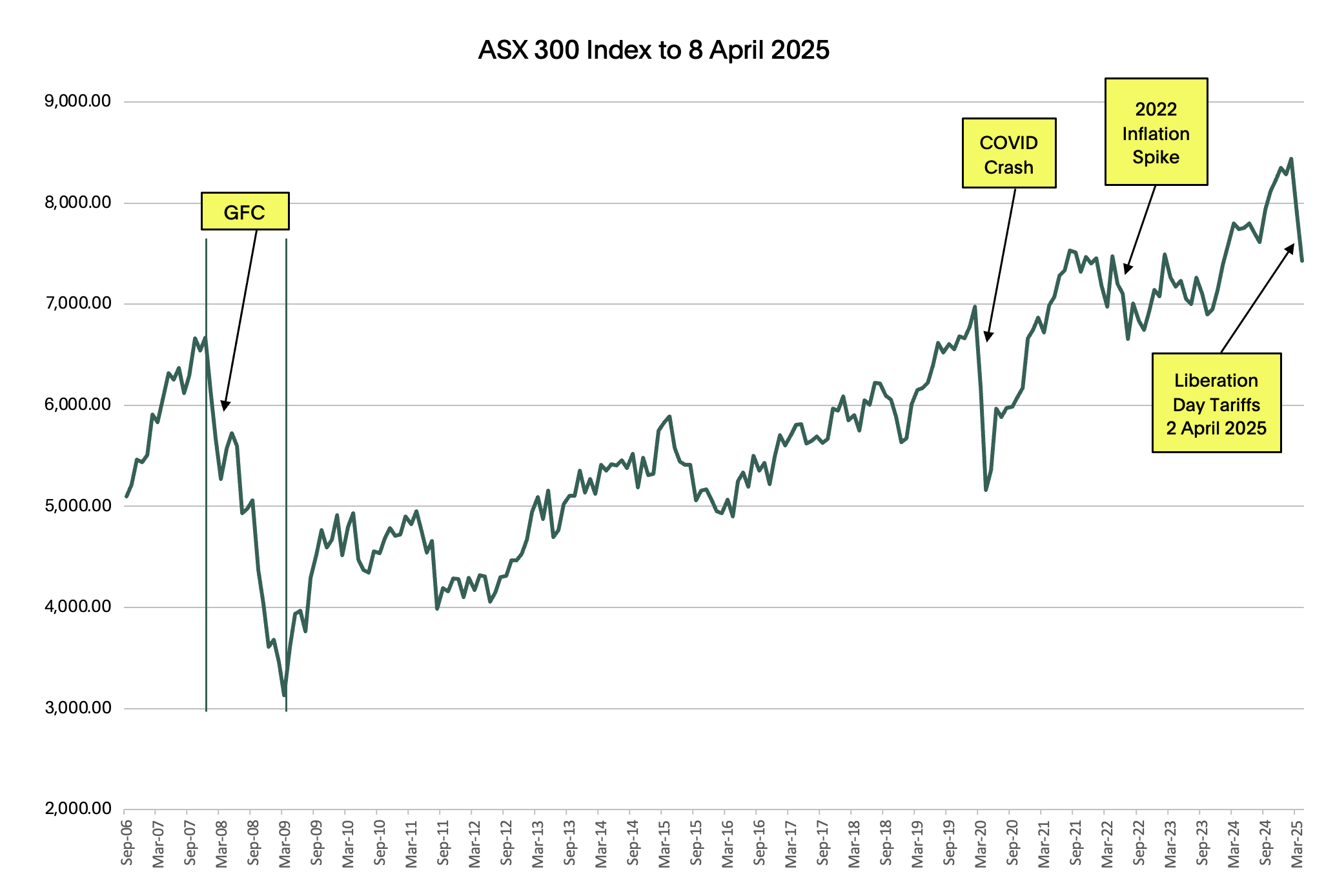

Share markets have dropped in recent days, starting in the United States and extending to share markets globally, including in Australia.

On Monday, the Australian Stock Exchange dropped close to 5%, which is significant but not unprecedented for a single day.

There are numerous examples of share market movements of this size and magnitude. It’s important for investors to step back and consider that share markets rise over time, which helps put day to day corrections into context.

Source: FactSet

Australian Ethical has been applying its pioneering and authentic ethical investment process in all sorts of market conditions and scenarios for close to 40 years. We draw on all of this experience and expertise to navigate the market movements, while looking for opportunities to improve investment returns for the future.

The share market ups and downs of recent months became more pronounced on April 2 when US President Donald Trump announced tariffs on imports from all countries, and additional tariffs on countries with large trade deficits to the US.

Share markets have been reacting to this news, partly due to the uncertainty created by these announcements, and partly because of the fear that tariffs might slow down the economic growth which fuels share market returns.

At Australian Ethical, we believe we are well placed to navigate these ups and downs and continue to generate returns over the long term.

Our superannuation fund and managed funds invest in various asset classes, so when share markets are down, our investments in fixed income and private markets, for instance, tend to provide stability and diversification away from equity markets.

We also have a strong focus on valuation, something we have talked about recently as share prices in the US technology sector have been rising. This means we are reluctant to overpay and be left holding overpriced and therefore more risky investments. Our Ethical Charter has steered us clear of companies involved in fast fashion, which have been particularly hard hit by tarriffs in recent times.

If you’re feeling worried about investment returns, you may wish to seek financial advice before making decisions based on the short term versus the longer term of holding onto investments. Investors who sell out after heavy market falls could 'lock in' their losses and thereby miss out on a possible recovery. We outlined some tips if you’re checking your investment performance or considering which investment option is right for you.

Important Information

Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949) is the Responsible Entity of the Australian Ethical managed funds. Interests in the Australian Ethical Retail Superannuation Fund (ABN 49 633 667 743, USI AET0100AU) are offered by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949) and issued by the Trustee of the Fund, Australian Ethical Superannuation Pty Ltd (ABN 43 079 259 733, RSE L0001441, AFSL 526 055).

This information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance. Please read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website before making any decision about what is appropriate for you.

Past performance is not a reliable indicator of future performance.

Ratings or investment returns are only one factor you should consider when deciding how to invest. Remember, superannuation is generally a long-term investment.

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.