Market update – share markets are up

Share markets globally had a strong start to the year. In the United States in particular, valuations of the world’s largest companies have been climbing.

It’s the technology companies leading the way – the so-called Magnificent 7: Meta, NVIDIA, Amazon, Apple, Alphabet, Microsoft and Tesla have had a good run of returns.

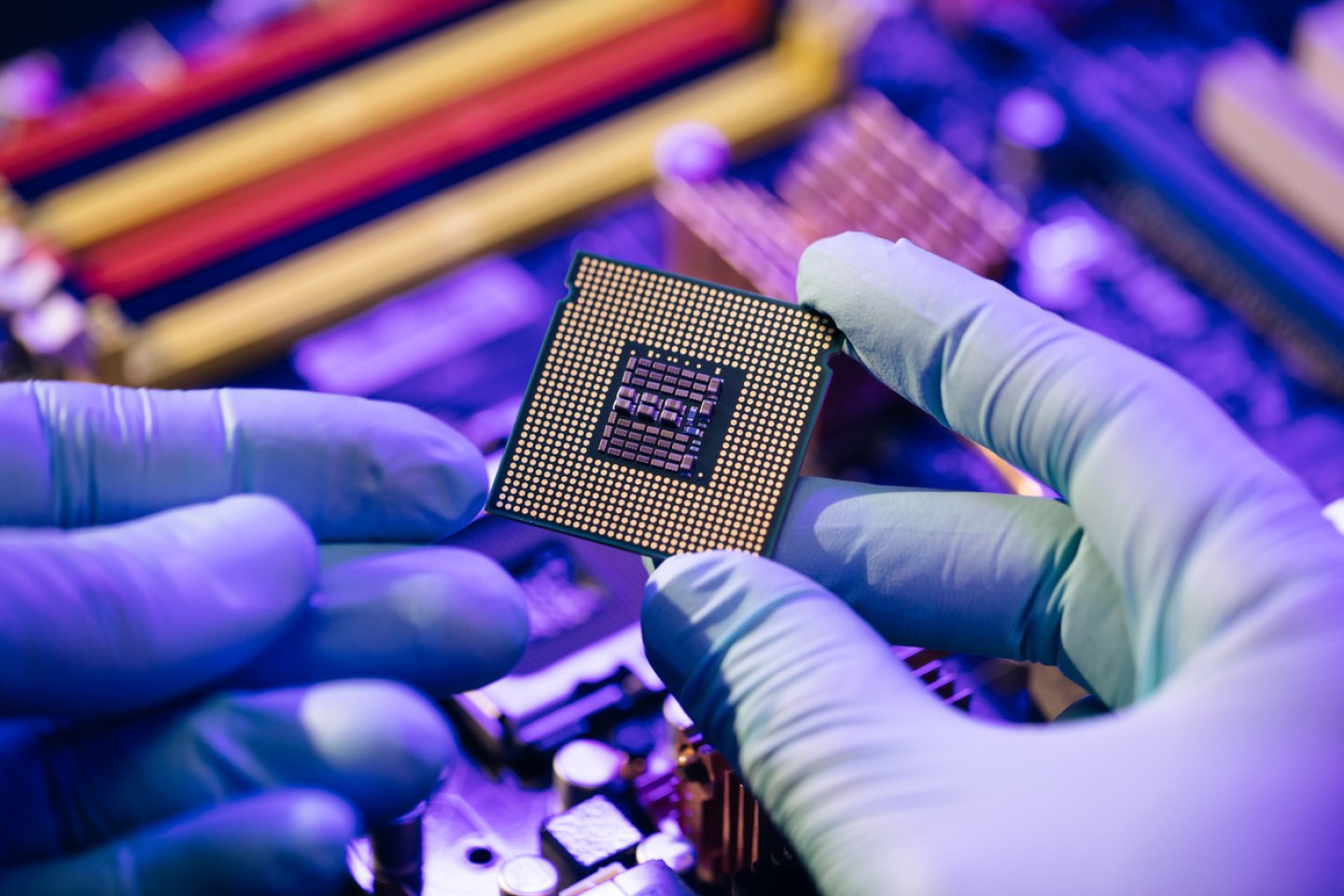

NVIDIA in particular, the US-listed chip maker that’s heavily involved in Artificial Intelligence, has been a lightning rod for the hype surrounding AI and the effect these new technologies will have on our lives and how we work.

The Australian share market has been performing well too, continuing the trend from late last year, which brought a fresh wave of demand for investing in listed companies.

Our super investment options have been keeping up with their target returns and overall market performance.*

Australian Ethical super option performance vs. target returns

| First 3 months of 2024 (%) | 1 year (%) | 7 years (%) | 10 years (%) | |

|---|---|---|---|---|

|

Australian Ethical Balanced Accumulation option Target: Consumer Price Index +3.25% |

4.8

|

10.3

|

7.1

|

7.1

|

|

Australian Ethical High Growth Accumulation option Target: Consumer Price Index + 4.25% |

7.2

|

15.2

|

9.0

|

8.9

|

|

Australian Ethical Australian Shares Accumulation option Target: ASX300 Total Return Index |

7.9

|

17.3

|

9.3

|

10.6

|

|

Australian Ethical International Shares Accumulation option Target: MSCI World Index ex Australia |

10.1

|

23.5

|

10.8

|

9.8

|

*Option returns are net of fees and tax. CPI benchmarks are gross. Returns are for the periods outlined to the end of March 2024

Our super options are designed to deliver returns that consistently outpace inflation, so your money is worth more when you need it, not less.

Target returns explained

We have included target returns above next to our super option returns to show how our performance compares.

A big part of investing for retirement is making sure you’re not going backwards. This doesn’t just mean making sure you are avoiding losses, but it also ensuring your savings are, at a very minimum, not falling behind the pace of inflation.

Inflation is a measurement of price of goods and services over time, which effectively relates to your spending power. If inflation is going up, your money is effectively worth less.

The Consumer Price Index (CPI) is how we measure inflation – at the end of March CPI was 4.1%.1

Anyone investing for the future should be looking at their savings and investment performance with inflation in mind to ensure the spending power of their savings is not going backwards.

Our super options are designed to deliver returns that consistently outpace inflation, so your money is worth more when you need it, not less.

It’s the technology companies leading the way – the so-called Magnificent 7: Meta, NVIDIA, Amazon, Apple, Alphabet, Microsoft and Tesla have had a good run of returns.

Where to from here?

A consequence of strong performance can be heightened risk. While we don’t have a crystal ball to predict the future, in recent weeks and months we have been selling some of our more expensive listed company positions and buying defensive investments designed to lose less than the broader market and our peers if share markets do drop.