Investing through the bumps

In the last three months, we’ve seen share markets move up and down. We call this ‘market volatility’, and it’s taken some investors by surprise.

Volatility is normal, and caused by several factors. This year, we think a major reason for the inclines and declines was how expensive the markets were in the middle of 2024.

Back in July 2024 we talked about how markets in Australia, the United States – as well as many other regions around the world – were at, or close to, their highest levels ever. When markets are expensive (worth more), there’s a greater risk they can dip. And that’s what happened in August and September.

The good news is our funds performed well during the volatility of the last three months.

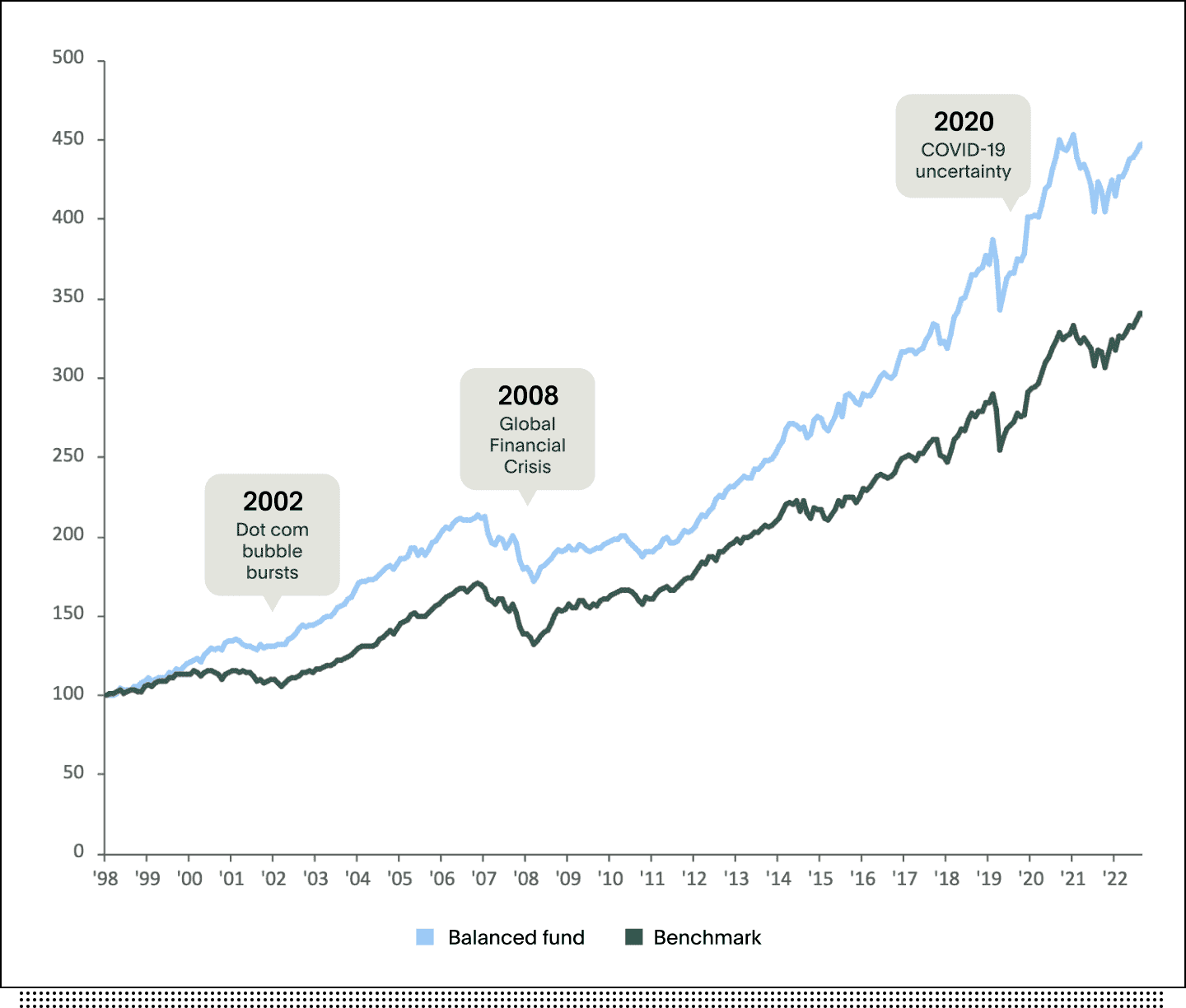

We’ve talked about how our approach to investing errs towards caution when it comes to shares we think are overvalued. Investing this way means the dips don’t impact our performance as much. The flip side is that our short-term performance doesn’t get as much of a bump when there’s a sharp incline in market values. But having a measured approach to growth means that we don’t rise or drop quickly, but maintain steady growth over the long-term. In superannuation, when most people are investing for thirty plus years, the long-term is what matters most to us.

We are not the same as a lot of other super funds, which is probably why you are with us. Our portfolios look different because they reflect our purpose to invest for a better world.

Australian Ethical super option performance vs. target returns

| 3 months to Sept (%) | 1 year (%) | 10 years (%) | |

|---|---|---|---|

|

Australian Ethical Balanced Accumulation option Target: Consumer Price Index +3.25% |

3.9

|

12.1

|

7.0

|

|

Australian Ethical High Growth Accumulation option Target: Consumer Price Index + 4.25% |

5.0

|

16.0

|

8.7

|

|

Australian Ethical Australian Shares Accumulation option Target: ASX300 Total Return Index |

10.0

|

21.3

|

9.8

|

|

Australian Ethical International Shares Accumulation option Target: MSCI World Index ex Australia |

3.0

|

20.4

|

9.8

|

*Option returns are net of fees and tax. CPI benchmarks are gross. Returns are for the periods outlined to the end of September 2024. Past performance is not a reliable indicator of future performance.

See performance for all super options

What's happening with mining companies?

We restrict investment in extractive industries like mining, but how shares in these companies perform still affects our relative returns – that is, how we compare to our mainstream competitor funds and the broader market that do hold them.

Energy and mining companies have had a tough 12 months or so. The reason? China’s economy has slowed, resulting in China not building as much, which in turn creates less demand for commodities like iron ore, which is used to make steel and other kinds of industrial materials.

This has been a positive trend for our funds (although we do own some miners of minerals that contribute to the energy transition, like Lithium used in batteries for instance). The lower allocations we have to miners and energy companies compared to the broader market and many of our competitors has helped our returns over the period.

However, there will be times this trend reverses, and it will have a negative effect on the relative performance of our funds in the short term. This happened at the end of September, when the Chinese government pumped some money into its economy. As a result, shares in Aussie mining companies picked up.

There will be times our funds perform differently than our peers and the broader market, it’s because we are different. That difference derives from what we do and don’t invest in, following our Ethical Charter.

We believe over the long term our way of investing can generate investment returns while helping to make a better world. Our long-term performance shows you can invest ethically and generate investment returns.

Balanced Fund Super Option return is net of investment fees, admin fees and tax, gross of $-based member fee.

Peer fund benchmark was Morningstar Multisector Balanced - Superannuation index until Mar-2015, Morningstar Multisector Growth - Superannuation index until Dec-2019, SuperRatings SR50 Balanced (60-76) Index to current. Peer fund return is net of investment fees, admin fees and tax, gross of $-based member fee.

Interests in the Australian Ethical Retail Superannuation Fund (ABN 49 633 667 743, USI AET0100AU) are offered by Australian Ethical Investment Limited (ABN 47 003 188 930, AFSL 229949) and issued by the Trustee of the Fund, Australian Ethical Superannuation Pty Limited (ABN 43 079 259 733, RSE L0001441, ASFL 526 055).

The information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Past performance is not a reliable indicator of future performance.

Ratings or investment returns are only one factor you should consider when deciding how to invest. Remember, superannuation is generally a long-term investment. For details on the risks and fees of investing in Australian Ethical Super, please refer to the Financial Services Guide and Product Disclosure Statements on australianethical.com.au

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.

This commentary may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Australian Ethical accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.