Investing in tech when markets are expensive

If we’ve learned anything in the last year, it’s to not underestimate the impact technology will have on our future societies, or on our portfolios.

It was a little over a year ago when ChatGPT was unleashed on the general population, almost immediately changing the way we think about the future of working.

In that short space of time, the so called Magnificent 7 US-listed tech stocks have returned well over 100%, doubling the NASDAQ’s more than 50 per cent gains over the period and amassing market capitalisation multiple times the size of entire countries’ gross domestic products.

NVIDA, the chip maker that’s heavily involved in Artificial Intelligence, has become the poster child for this latest technology wave, fuelled by our optimism around AI and its expected impact on our lives. NVIDIA’s share price has defied logic at times, rocketing well above $800 per share from around $200 a share where it was trading a year ago.

In Australia, there’s a similar story forming, but with a few local market twists.

Aussie investors have watched better-known software and information technology names benefit from the return of investor sentiment to equities. The likes of Wisetech, Xero, Pro Medicus, Altium and Technology One have all benefited from the rotation into risk assets towards the end of 2023, as interest rates have peaked, and long bond rates have been driven down.

Now, it’s fair to say, equity markets are expensive.

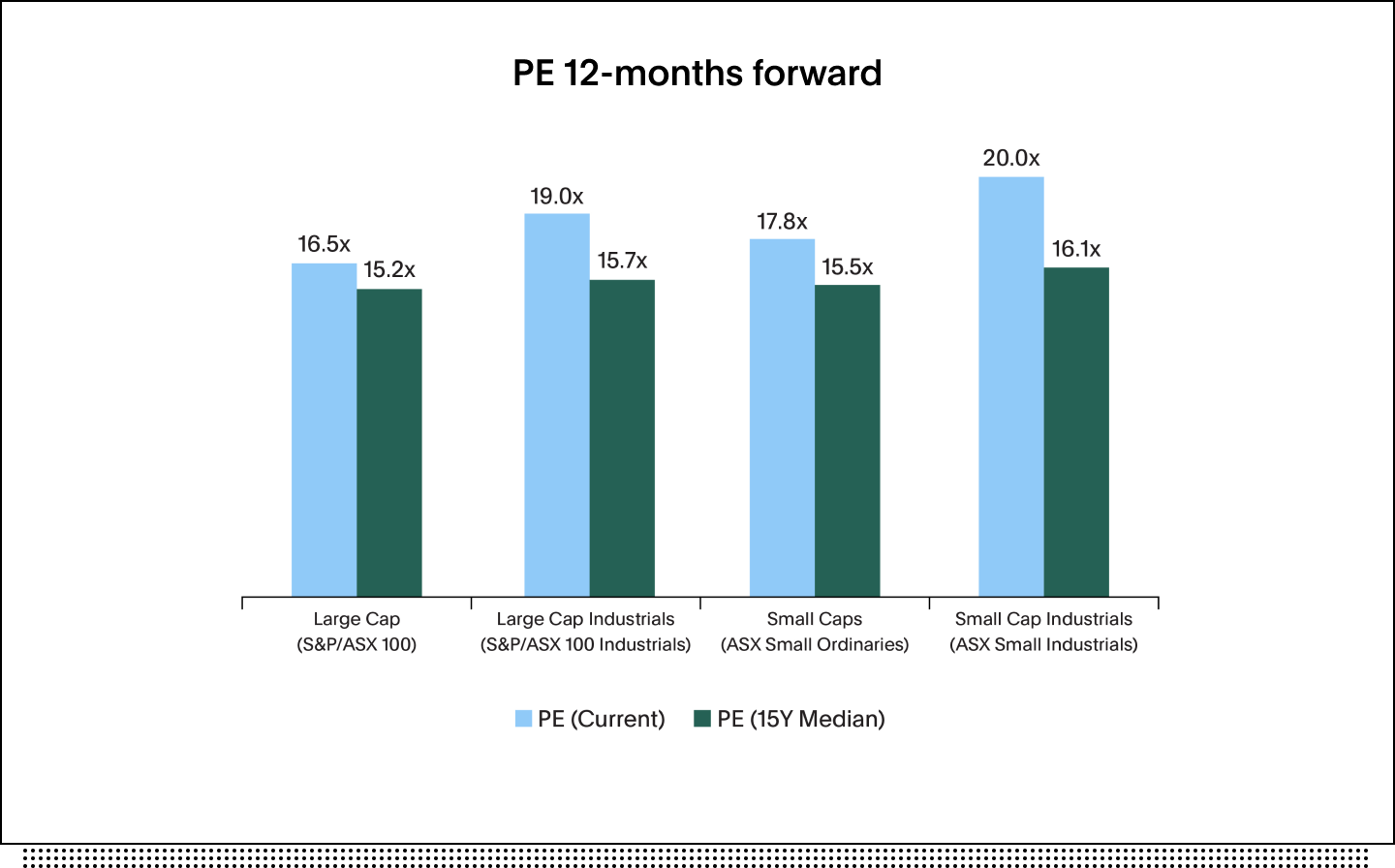

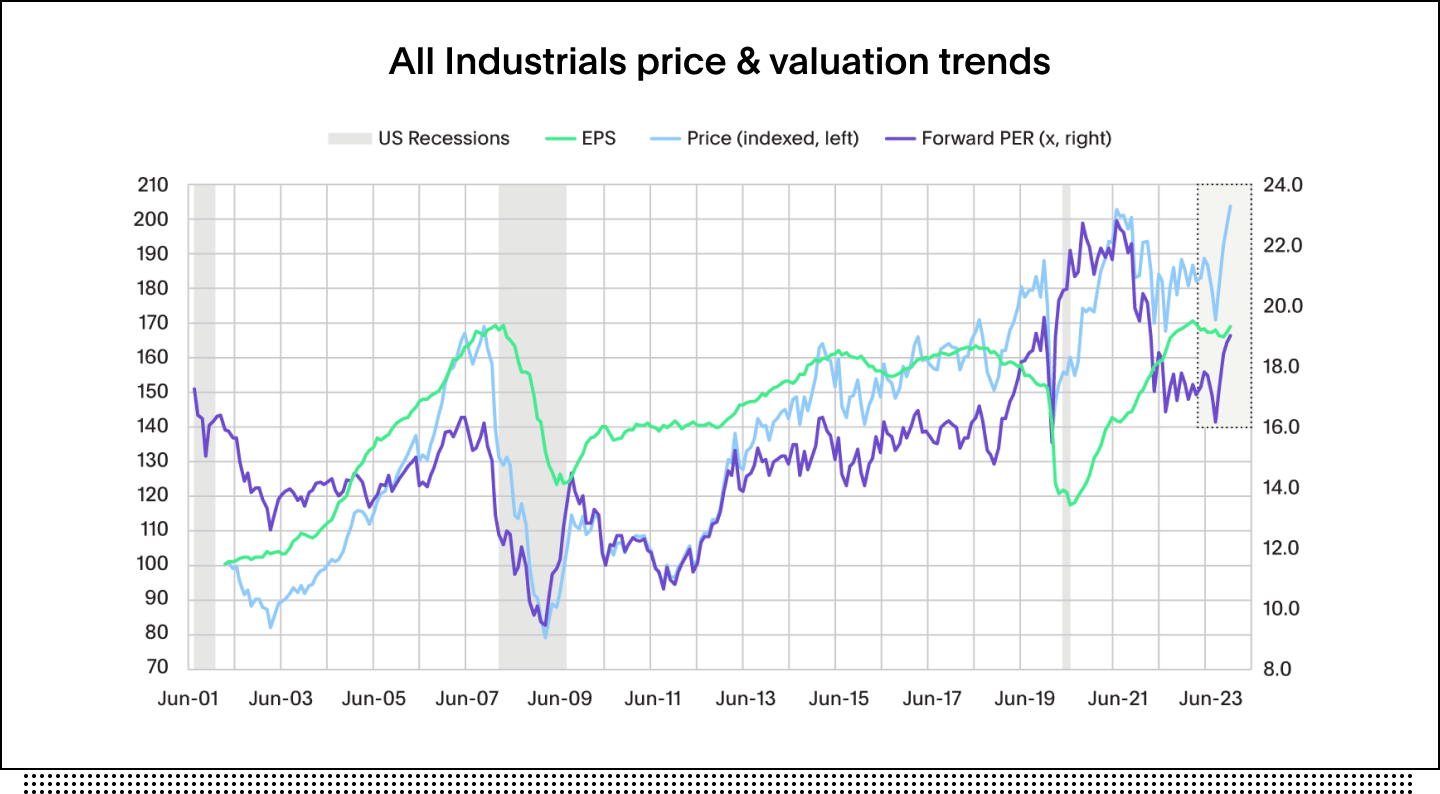

Valuations are elevated by whichever measure you look at it.

Source: B* Data & Quant, Factset, 28 February 2024.

And when you take away the parts of the share market that traditionally trade on lower price-earnings multiples like resources, we’re at even more elevated levels.

Source: Macquarie Insights

Local share market valuations are trading above their 15-year averages. When you go down the market capitalisation spectrum, it’s a similar story – the share market is elevated looking at forward 12 months price to earnings multiples relative to the 15-year historical average.

Is now really the time to be investing in tech? Well, yes, and no.

We are in a period of significant technology transformation – technology is bringing efficiency to society, enabling our transition to renewable energy, making our lives and workplaces more efficient. But, considering valuations, you want to be sensible about the bets on tech you’re placing now.

It’s likely some tech and growth-style company valuations are becoming detached from fundamentals – this is reflected in the limited upgrades and some downgrades to earnings guidance during the latest reporting season despite rocketing valuations. This follows a large downgrade cycle in 2023.

Companies that changed quantitive guidance

Because our portfolios are naturally skewed towards future-focused growth companies, we spend a lot of time thinking about valuation in this growth-oriented end of the market.

Our ethical process means we don’t even look at about 40 per cent of the share market, particularly within energy and materials, which is reflected in our healthcare, information technology and renewables heavy portfolios.

The Australian Ethical Emerging Companies Fund (Wholesale) will celebrate its 9th anniversary this year, has returned 12.6% since inception. Over 7 years, it returned 11.8% per annum. Over 5 years it returned 12.5% per annum (net of fees). All figures are net of fees and as at 29 Feb 2024. This is compared to the fund’s benchmark, the S&P/ASX Small Industrials index which returned 6.9%, 6.3% and 4.3% (gross of fees) over those same periods.

Above all – and particularly at times of relatively elevated valuations – we like to have a growth focus with a valuation discipline.

Tech we like

Within tech, we particularly like the software models with strong recurring and sticky revenue streams. We look to invest in companies with the ability to grow these revenues.

We end up favouring software companies that are not focused on the east coast of Australia. We like companies that have global aspirations, with revenue streams and addressable markets considerably larger than Australia. When we are investing in tech, we want to be playing a global thematic but listed on the ASX.

Nuix is an example that ticks a lot of boxes for us as a local technology investment – software over hardware, a scalable business model and preference for global revenue. It’s also not yet one of the ASX darlings tech investors in Australia have really discovered yet.

Another company that we've recently brought into is Webjet, which includes its technology enabled WebBeds business. WebBeds is a B2B marketplace that provides hotel beds to the global travel industry. We think it's a great business, it's on a reasonable forward-looking multiple of around 20 times (as at end of February this year). And we think travel is a long-term thematic that’s not going away. Overall, we think countries with higher GDPs will continue to spend more on travel.

The tech and software names we invest in tend to have lower valuation multiples than their peers in the market. One of the ways we measure valuation is using an enterprise value to sales multiple, which can give a clearer picture of the expectation built into some of these earlier stage companies.

FY2 (FY25) Consensus

| Company | EV/Sales | Price to Sales | Market Cap (M) |

|---|---|---|---|

| WiseTech Global | 24.3 | 24.2 | 32,026 |

| Xero | 11.2 | 11.9 | 21,905 |

| Pro Medicus | 48.7 | 49.3 | 10,076 |

| Altium | 14.6 | 15.0 | 8,611 |

| Technology One | 9.6 | 10.0 | 5,478 |

| Gentrack Group | 4.9 | 5.1 | 795 |

| Nuix | 3.1 | 3.2 | 706 |

| Bravura Solutions | 2.2 | 2.6 | 658 |

| Mach7 Technologies | 3.7 | 4.2 | 165 |

| Ansarada Group | 3.4 | 3.7 | 250 |

| Bigtincan | 0.6 | 0.6 | 100 |

Source: FactSet data, FY1 (forecast financial year)

We like to see an objectively calculated and decent size total addressable market; a global focused business is preferred with barriers to entry such as intellectual property. When investing in tech, we think it’s important to be able to understand the business model easily, as complexity can bring problems.

Valuation is key

Above all – and particularly at times of relatively elevated valuations – we like to have a growth focus with a valuation discipline.

In some ways we think of ourselves as quite valuation-oriented, given we’re looking for business models with strong recurring revenues, resilient balance sheets, and healthy cashflow generation. We’re looking for opportunities where companies are attractive from a multiple perspective and attractive relative to the broader market or even peers within the sector.

We think this valuation discipline gives us a good buffer if things don't maybe pan out as well as we'd like in the near term, because we think the long-term opportunity is really attractive.

Part of being a value-oriented growth investor is we’re unlikely to chase momentum, which means we’re unlikely to be invested in the well-known tech names that might light up the equity markets in the short term when growth and tech is running hot.

This information is general in nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Consider if the products are right for you and read the relevant PDS and TMD at australianethical.com.au. Issued by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229 949) Past performance is not a reliable indicator of future performance. Risk level for this fund is very high. Investing ethically means that the investment universe will generally be more limited than non-ethical portfolios. Returns and volatility may accordingly vary compared to non-ethical portfolios over all investment timeframes. Past performance is not a reliable indicator of future performance.

Get in touch

If you would like to find out more about our Emerging Companies Fund, fill in your details below and our Business Development team will be in touch.