How we’re investing in a lower-carbon world

At Australian Ethical, we are all about finding the sweet spot between investing for the good of the planet while also generating investment returns.

So, it’s probably no surprise that the current shift from fossil fuel generated power to low carbon emitting, sustainable and renewable energy sources is a big focus for our investments.

We are in all sorts of investments linked to the energy transition in different ways – from private equity, venture capital, private markets, listed-equity, through direct investments, partnerships and debt financing arrangements.

The scale of investment required to slow warming to well below 2°C and to pursue a limit of 1.5°C in line with science-based targets is immense – perhaps even daunting – for investors wondering where to invest to take advantage of the opportunity.

The opportunity

To add some historical context – this is not the first energy transition we’ve witnessed.

In the last 200 years, the world has moved from steam engines and oil lamps to internal combustion engines and wide-scale use of electricity. This latest transition is powered by the realisation that avoiding the catastrophic effects of climate change requires a reduction in Greenhouse Gas emissions1.

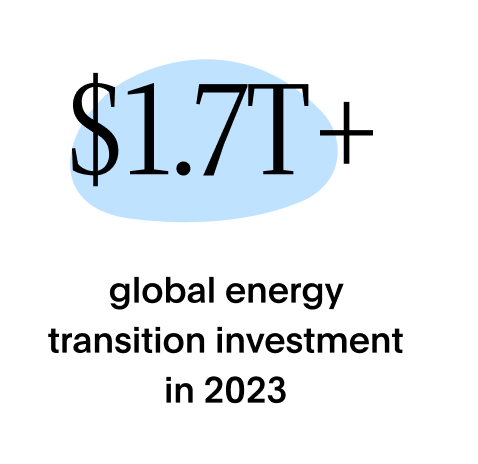

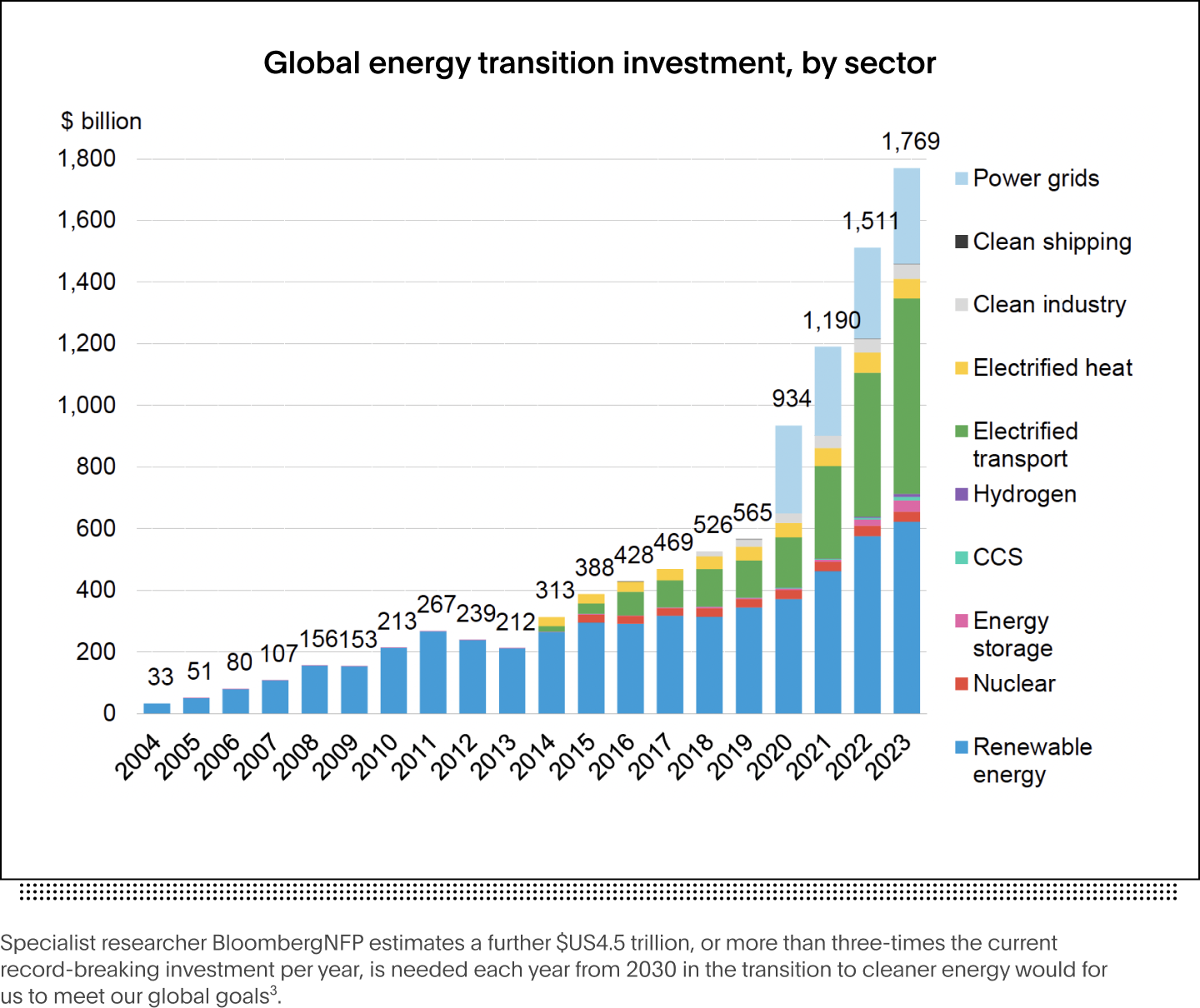

There was $US1.8 trillion spent on the energy transition globally in 2023 alone, led by investment in electrified transport, transformation of power grids, renewable energy generation like wind and solar2.

How Australian Ethical is investing

How and where we invest reflects our view on the progress of the energy transition to net zero carbon at any given time. We can adjust our strategic and dynamic asset allocation to ensure we are delivering the right kinds of capital to the right places.

For instance, we are in a period we believe technology can play a role in leapfrogging to where we need to be to stay in line with our emissions reduction targets – so we invest in venture capital, early-stage technology and innovation through our investments in the likes of CSIRO-backed Main Sequence and Artesian.

We not only restrict+ investment in companies assessed to be obstructing the objectives of the Paris Agreement, we also invest in companies accelerating the move towards a cleaner energy future.

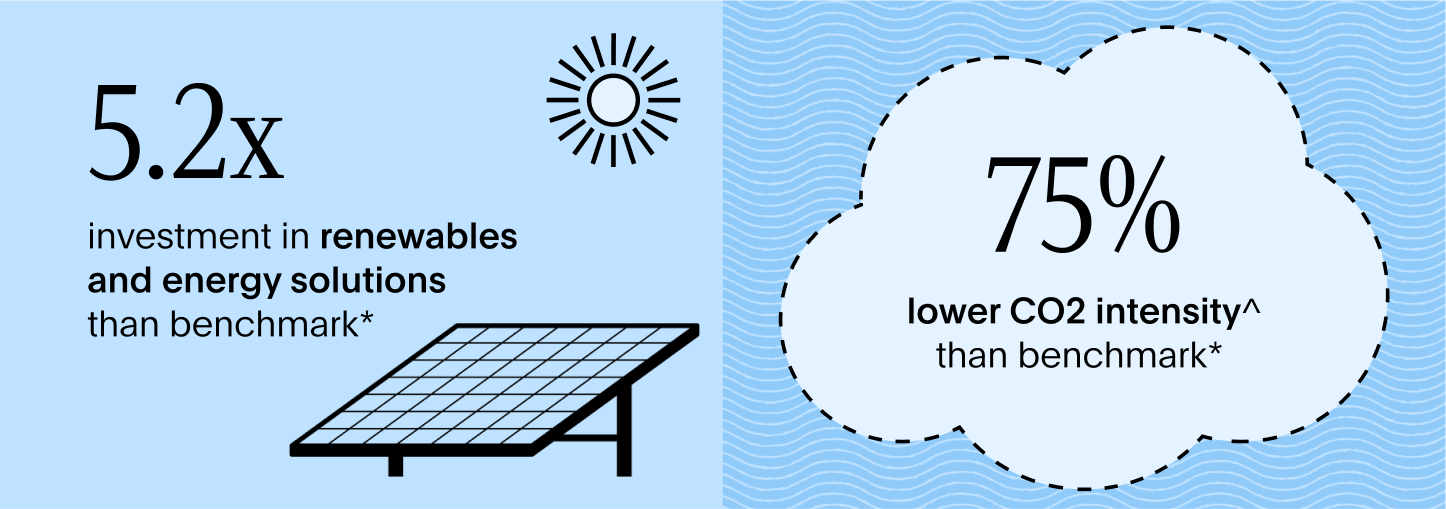

Every year we measure the carbon intensity and exposure to renewable energy solutions in our listed portfolios. In the latest reporting period for the year to the end of August 2024 our listed share investments had 75% lower CO2 intensity and 5.2 times investment in renewables and energy solutions compared to mainstream benchmarks4.

Some of the opportunities we invest in are private – so not in publicly listed markets. To access these kinds of investments we create partnerships like the one we recently strengthened with private equity manager, Generation Investment Management. Through this partnership we have a joint investment in UK-based energy retailer, Octopus Energy, which leads the transition to renewables based on a market-leading energy markets technology platform.

There are some publicly-listed opportunities – we were early investor through our local smaller and mid-cap strategies in Australia and New Zealand including Gentrack, Contact Energy and Meridian Energy. These companies may not be in mainstream benchmarks but, they are contributing to the acceleration of the energy transition.

Because climate change is a top factor we consider when we invest because of its wide-ranging implications for people, animals and the planet, it naturally positions as at the forefront of one of the great mega-trend of our time.

Find out more about our vision to create a world where money is a force for good.

1 The world's energy transitions: a history told in infographics | World Economic Forum (weforum.org)

4 Scope 1 and 2 carbon intensity (tonnes CO2-e /$ revenue), sustainable impact solutions revenue, and investment in renewables and energy solutions measures all relate to the listed companies whose shares we invest in across our funds and options for which we have relevant data. This should not be considered representative of individual funds or options which will have their own mix of share and other investments. See page 174 of our 2024 Annual Report for more information about this comparison. For our analysis we use sustainable impact criteria and revenue data from external sources which aim to measure revenue exposure to sustainable impact solutionsand support actionable thematic allocations in line with the U.N. Sustainable Development Goals (SDGs), EU Taxonomy of Sustainable Activities, and other sustainability related frameworks. More information available on page 174 of our 2024 Annual Report.

Interests in the Australian Ethical Managed Funds are issued by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949), the Responsible Entity of the Australian Ethical Managed Funds.

The information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Investing ethically and sustainably means that the investment universe will generally be more limited than non-ethical, non-sustainable portfolios in similar asset classes. This means that the portfolio(s) may not have exposure to specific assets which over or underperform over the investment cycle, and so the returns and volatility of the portfolio(s) may be higher or lower than non-ethical, non-sustainable portfolios over all investment time frames.

This commentary may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Australian Ethical accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.