Understanding your super performance

Here are three quick questions to ask yourself. Do you know:

- Which investment option your super is invested in?

- What its return objective is?

- What its actual return is?

If your answer is “No” to any (or all) of these questions, that’s okay, lots of people probably don’t. But you’re most likely putting 11.5% of your income into superannuation, so it’s worth checking how it’s going.

First, check the investment objective

Your investment option has a return objective. For example, our High Growth investment option has this objective:

“To provide long term growth accompanied by high levels of risk through holding growth assets. The option aims to achieve returns 4.25% per annum above inflation after investment fees and taxes over a 10 year period.”

Importantly, this percentage is the return after taking inflation into account. Our options are designed to keep ahead of inflation, as measured by the Consumer Price Index (CPI) so your spending power doesn’t get eaten into when you retire. You’ll usually see the objective displayed like this:

‘CPI+ 4.25%’ per annum.

Now, check performance against that objective

To find out how your super is doing:

- Log in and check which investment option you’re in by clicking on ‘Investments’ in the top menu of the member portal.

- On the performance page of the website, click on your investment option name and make a note of the stated return objective for your option.

- Go back to the performance page and have a look at how your returns have been tracking in relation to their objectives.

How is yours doing? The Australian Ethical Balanced (Accumulation) option for example, has achieved 6.6% per annum net of fees over the last ten-years to the end of February 2025, which is above its CPI+ 3.25% objective. Note that past performance is not a reliable indicator of future returns.

Long-term and short-term performance

You’ve probably noticed that the performance figures vary with time. As the end of February this year, the one-year return for the Australian Ethical Balanced (Accumulation) option is 9% per annum, but over ten years it’s 6.6% per annum.

When reviewing performance, it’s important to look at the period that best relates to your life stage and investment option. You might have noticed that each option also has a suggested investment timeframe. This is the number of years we recommend being invested in an option to get the best return outcome.

For the High-Growth option for example, this is ten years, because it’s intended for people with a longer timeframe who can accept higher risks. By contrast, the timeframe of the Conservative option is only four years, because this option is for people with a lower risk tolerance who prioritise capital stability and income generation. It is particularly suited for those in or approaching retirement, where preserving wealth and maintaining a steady income stream take precedence over higher-risk growth strategies. Some options have higher returns, fees (and risks) than others.

Every investment option invests in a mix of different ‘asset classes’, with different risks and rates of return, specifically chosen to meet the option’s return objective.

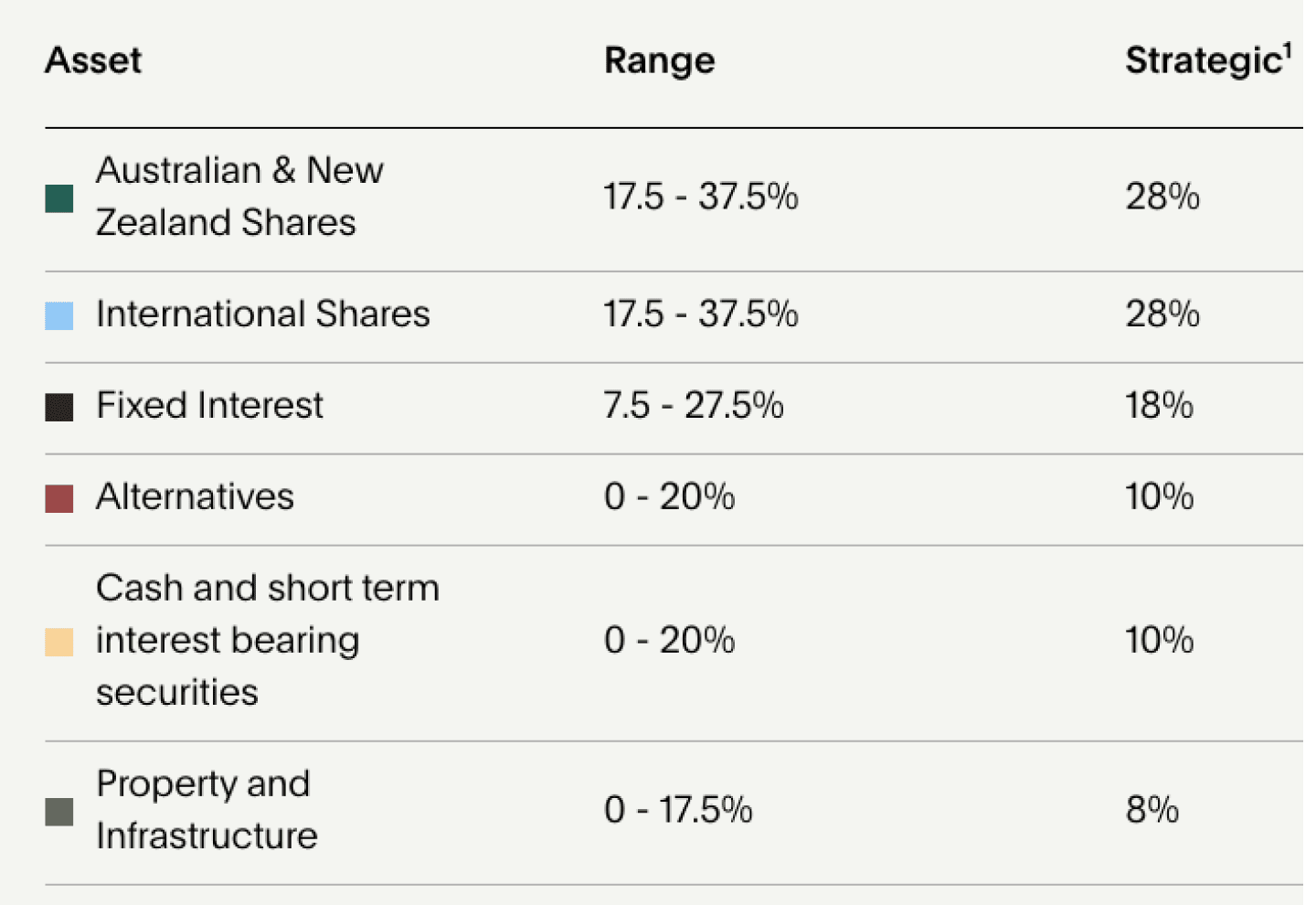

We provide seven options that offer a range of risk/return combinations to suit different members. The Balanced (Accumulation) option for example, splits your money across six asset classes:

As at 13 February 2025.

This information is subject to change.

- The asset allocation shown is a strategic asset allocation and the actual allocation may vary within the range due to market movements, investments into or withdrawals from the option, or changes in the nature of the investment.

- No more than 20% of the option’s exposure to Australian and New Zealand shares will come from securities listed on the New Zealand stock exchange.

It’s called ‘Balanced’ because it’s a mix of high-risk/high-return assets (e.g. shares and property) and low-risk/low return assets (e.g. cash, fixed interest).

Which option is best for you?

When it comes to super, there are generally three main stages during your lifetime, and the most suitable investment options change in each stage.

Stage 1 – Accumulating

In your younger years, a Growth or High Growth option is likely to maximise your returns. You may be better placed to accept the higher risk because you have plenty of time to ride out any falls in share markets.

Stage 2 – Consolidating

As you get older, moving some of your super into lower-risk options could help protect the growth you’ve achieved without sacrificing too much return.

Stage 3 – Protecting

Depending on your age and circumstance, the Conservative and Defensive options may become useful, particularly if you are planning to withdraw larger amounts from your super.

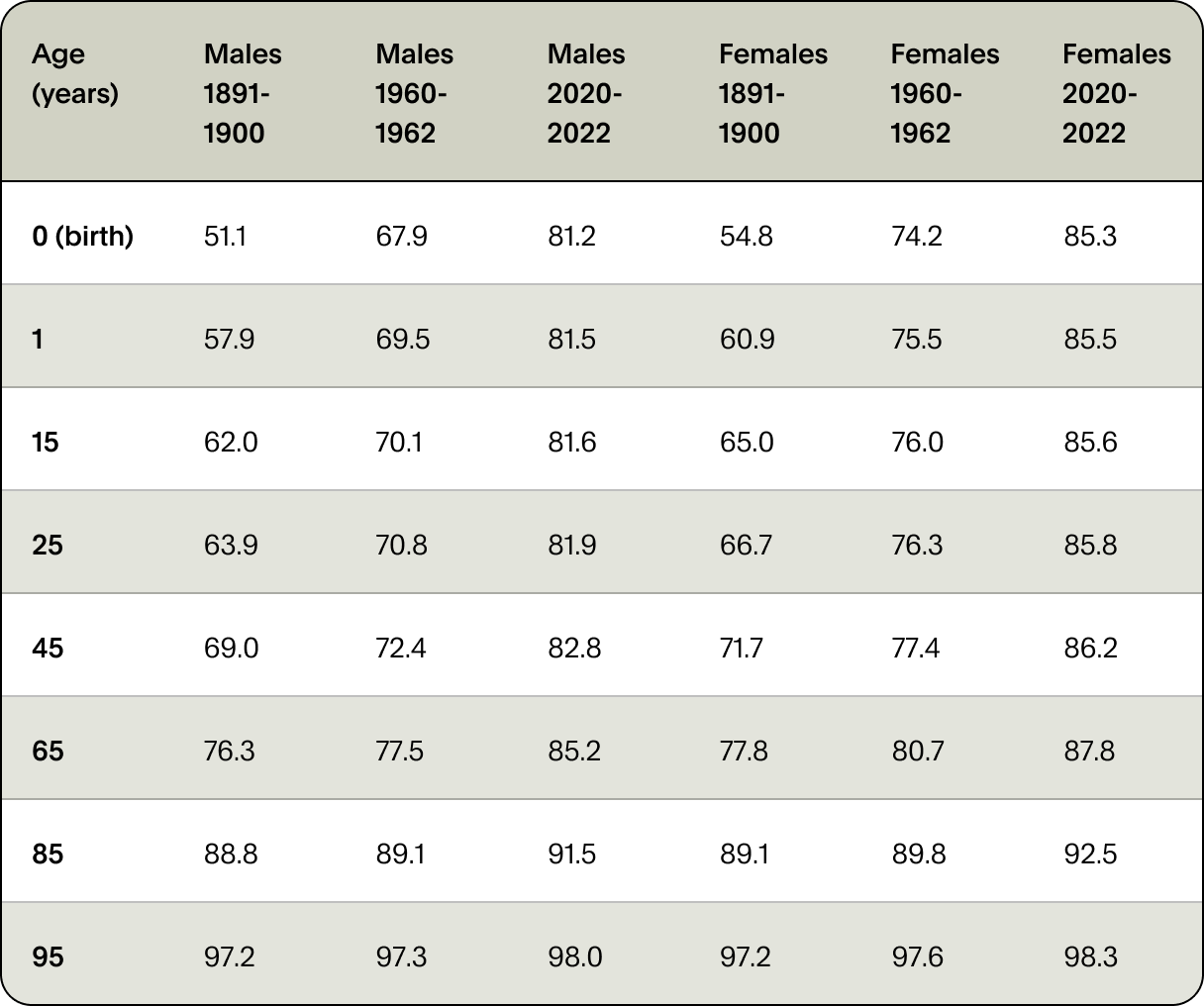

Keep in mind life expectancy for females is now over 84 and for males is close to 82 (according to the latest ABS stats, see table below. So even at 60 years old, you may still have a lot of time to generate returns. The return of these Conservative and Defensive options might be lower, but your investments are more geared towards capital preservation when markets dip.

Life expectancy (expected age at death in years) in Australia, at different ages and by sex, 1891–1900, 1960–1962 and 2020–2022

Sources: ABS 2014a; ABS 2023a; Table S8.1.

Keep an eye on your super and adapt

As you get older, it’s well worth checking in on your super to see how it’s performing and whether you’re still in the most suitable investment option.

A financial adviser can help you decide which investment option is best for you, depending on your age and your financial objectives, so always consult your adviser before making decisions about investment options.

Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949) is the Responsible Entity of the Australian Ethical managed funds. Interests in the Australian Ethical Retail Superannuation Fund (ABN 49 633 667 743, USI AET0100AU) are offered by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949) and issued by the Trustee of the Fund, Australian Ethical Superannuation Pty Ltd (ABN 43 079 259 733, RSE L0001441, AFSL 526 055).

This information is general advice only and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide (FSG), product disclosure statement (PDS) and Target Market Determination (TMD) available on our website.

You may wish to seek financial advice from an authorised financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

Past performance is not a reliable indicator of future performance.

Ratings or investment returns are only one factor you should consider when deciding how to invest. Remember, superannuation is generally a long-term investment.