Weighing up short and long-term performance

It’s been a challenging 24 months for many investors globally, but we believe we are well placed to navigate the risks and take advantage of the opportunities ahead.

For Australian Ethical Super members, our performance in the last year has been quite good despite volatile markets, with our Balanced option returning 9.6% the 12 months to the end of December 2023, well above its (CPI +3.25%) target which returned 6.9% for the same period.

This is an improvement over the lower performance numbers we posted in 2022 when our annual financial year return dipped into negative.

We believe our recent performance reinforces the quality and resilience of our approach to investing, which was established in 1986 and has navigated almost four decades of market ups and downs.

IN THIS ARTICLE

What's been happening with our recent performance?

Markets continue to be volatile and we will likely see ongoing fluctuations in quarterly investment performance this year. The main factors contributing to this uncertainty and fluctuations in valuation of companies and assets we own include high inflation and in particular high energy prices. As an ethical investor, we limit our exposure to the energy sector. And we will not invest in companies focused on fossil fuels or in fossil fuel expansions.

Russia’s invasion of Ukraine in 2022 led to the sharpest energy price rise in nearly half a century, which resulted in the continuing strong performance of energy companies in the first half of 2023 and the continuing strong performance of materials companies relative to the rest of the market through the remainder of the year, which accounted for lower performance numbers during these periods.

Russia’s invasion of Ukraine in 2022 led to the sharpest energy price rise in nearly half a century.

1. Rising energy prices

Performance of the energy sector has been volatile during the 2023 calendar year, particularly as conflict and geopolitical situations have arisen. High energy prices helped spur the performance of fossil fuel companies, particularly in the first half of the year. Meanwhile, materials companies finished the year strongly. In keeping with our Ethical Charter, our current portfolio has less exposure to materials and energy companies than the index because of our position on fossil fuels.

2. Interest rate rises

Aside from energy prices, rising interest rates have proven to be another headwind for equities portfolios in particular.

Central banks have increased interest rates to slow spending and borrowing in an attempt to reduce demand and lower inflation. Because of this, global investors became more cautious about the impact of higher interest rates on consumer spending and business profitability. Higher interest rates (and higher uncertainty) have also meant that the value of future earnings is worth less to investors today – meaning the value of companies that are expected to generate most of their profit in the future (known as growth companies) fell significantly.

3. Technology sector

Meanwhile, valuations of technology companies have been suffering as interest rates have been rising, although there was a rally in the valuations of these companies towards the end of 2023 when the market started factoring in future interest rate cuts. We have a relatively high exposure in the technology and healthcare sectors because of the positive contribution we believe these companies can make towards a better future, and we remain positive on technology over the long term.

We have a relatively high exposure in the technology and healthcare sectors because of the positive contribution we believe these companies can make towards a better future, and we remain positive on technology over the long term.

High energy prices, volatile commodity prices, and fluctuating demand for companies with higher expectation for future earnings were among the features of investment markets in the last two years. We believe our portfolios are well positioned for where the future is heading.

It's also important to remember that our Balanced option is a diversified portfolio, which means it includes investments in fixed interest, cash, infrastructure and property as well as listed shares. Investing in these other asset classes, which are typically less volatile than listed shares, means that portfolio returns are insulated from some of the significant volatility in share markets.

In this video, our Chief Investment Officer, Ludovic Theau, describes how we’re navigating risks and taking advantage of opportunities in the current environment.

What about our long-term performance?

We believe that the outlook for the long-term performance of our Balanced option remains strong, despite the short-term headwinds we’ve seen. This is because of our focus on future-building companies that we anticipate will thrive in a low carbon future, like IT, healthcare and education.

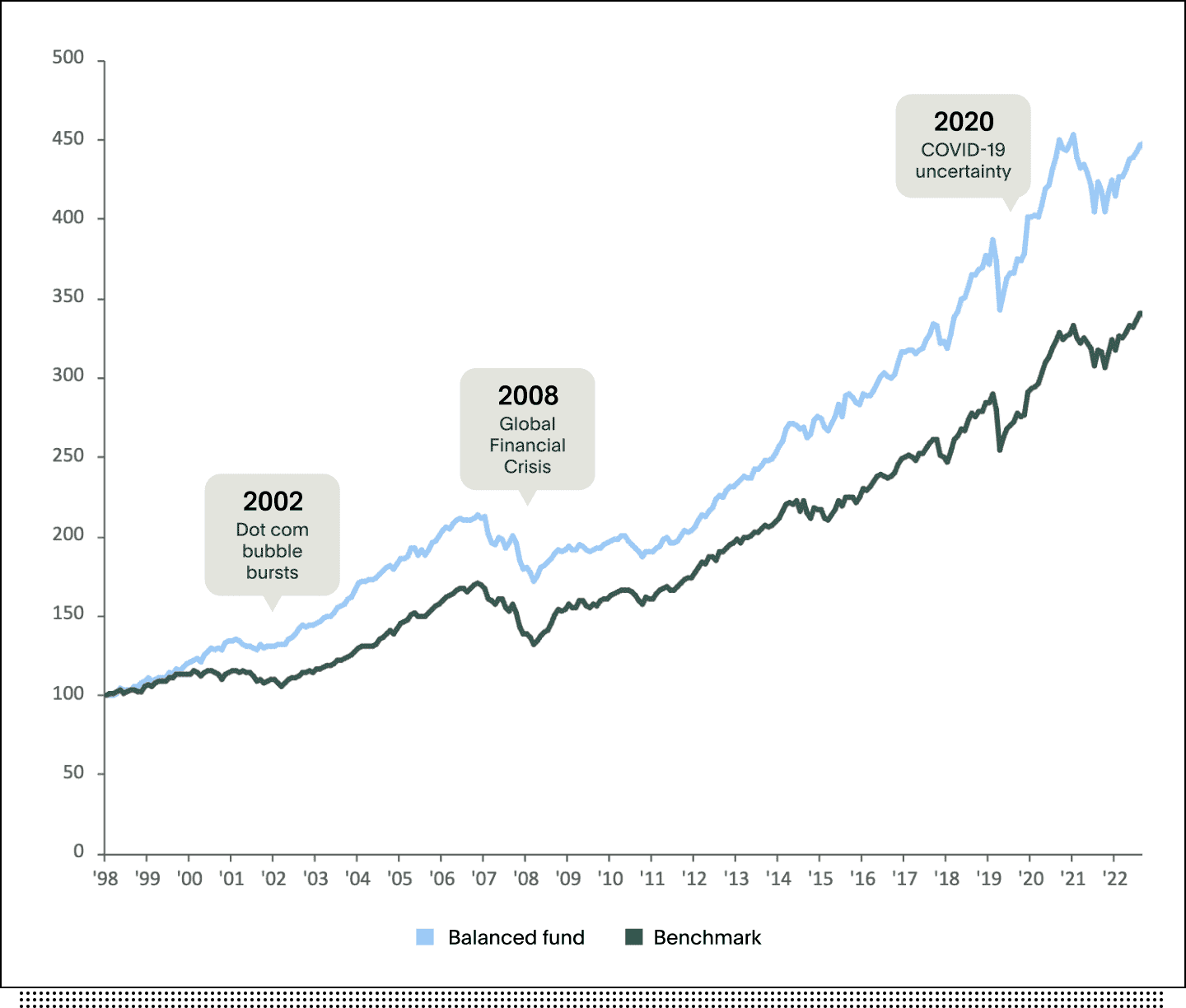

Balanced Fund Super Option return is net of investment fees, admin fees and tax, gross of $-based member fee.

Peer fund benchmark was Morningstar Multisector Balanced - Superannuation index until Mar-2015, Morningstar Multisector Growth - Superannuation index until Dec-2019, SuperRatings SR50 Balanced (60-76) Index to current. Peer fund return is net of investment fees, admin fees and tax, gross of $-based member fee.

We are pleased to report that over 5 and 10 years, our investment performance has continued to outperform its benchmarks.

In fact, data from independent researcher Chant West showed we are the only ethical super fund1 to make the top 10 performing growth funds over the last 10 years2. It's also the only retail fund to make the researcher's top 10 over 10 year list for the period to the end of December 2023, the research shows.

In terms of the outlook, we are now in a more normal interest rate environment. The market is pricing in interest rate cuts from here. Potentially lower interest rates are a good thing for the future-focused companies that we are investing in.

Small caps

Many of the best opportunities for future focused companies are found in organisations that are smaller, but show great potential for growth. This segment of the market is known as small caps.

We have been allocating capital to this relatively undervalued segment of the share market in our Balanced fund.

These earlier stage, small, growth-orientated companies have underperformed in the current rising interest rate environment, but we remain confident in their long-term growth prospects. We’re proud of our track record of identifying companies that are addressing real problems. We believe the structural drivers behind a low carbon future remain as strong as ever. Not just because of the supportive regulatory and policy environment, but also because of the growing demand from people who want to invest their money and their super in line with their values.

Hear from our ethics and investment team about how we’re investing in the transition minerals as part of the decarbonisation mega-trend across some of our portfolios.

Our singular focus on ethical investing, guided by our Ethical Charter, provides a stable lens through which to view the world. This means even when short-term returns are down, our approach to constructing our investment portfolios and advocacy remains unchanged. It’s how you can be sure your money is still invested for a better world for people, planet and animals.

We believe the structural drivers behind a low carbon future remain as strong as ever.

Back to top

The energy transition 'mega-trend'

The world’s progress towards decarbonisation is emerging as the biggest trend impacting our societies and financial markets in our view.

Already, more than 140 countries have signed up to net zero carbon commitments by 2050, accounting for more than 90% of global GDP. Meanwhile 20% of global energy consumption comes from renewables, according to the World Bank. These trends align with the focus of the latest COP28 meeting emphasised reducing reliance on fossil fuels.

As part of our investment strategy, Australian Ethical continues to provide capital and financing to renewable technologies. We are investing in renewable energy generation and we have recently funded two large Australian wind farms. We are using our capital and influence to support companies making a commitment to a lower carbon future.

We are using our capital and influence to support companies making a commitment to a lower carbon future.

Australian Ethical invests in renewable energy generation. We have recently funded two large Australian wind farms.

What are we doing about our short-term performance?

When markets are falling, it’s easy to become reactive and drift from established principles and processes in response to short-term market conditions.

To improve the likelihood of meeting investment objectives of super, our multi-asset super options provide members with a diverse mix of investments within growth and defensive asset classes, including the use of alternative assets to further diversify from traditional asset classes like shares and bonds. Further, asset allocation can be adjusted tactically for additional protection.

Alternative assets provide additional diversification benefits which can reduce risk and increase the likelihood of long-term objectives being met. Often alternative assets and strategies are only available to institutional investors.

Our investment management team constructs portfolios by considering risk and return. We believe in the power of compounding returns for longer term investment objectives and seek to reduce capital loss along the journey.

Alternative assets provide additional diversification benefits which can reduce risk and increase the likelihood of long-term objectives being met.

What should members do?

The reality is that market ups and downs are a normal part of investing and something our investment team is prepared for. Our long-term investment strategy is designed to be resilient when markets are volatile while maintaining its ethical focus.

Focusing excessively on short-term performance can lead to overlooking solid investments that may have occasional dips but tend to trend positively over time. Selling investments during market downturns to avoid short-term losses is a common (but unhelpful) human behaviour that can harm the ability to achieve long-term financial goals.

When markets fall, it’s normal to feel uneasy. In fact, many people feel the pain of an investment loss more than they enjoy the success of a gain! And though it can be hard to see at the time, when markets fall it’s often a time to find opportunities that may have been mispriced in the short term and make investments where we see long-term value.

Investing successfully for retirement relies on a steady focus and not being distracted by the twists and turns inevitable on any long journey. This is easier said than done, but history shows it is the best way to avoid crystallising short-term losses.

History shows that market downturns and recoveries are to be expected over the lifetime of superannuation investing. So panicking and moving your money into less risky options means you risk missing out when markets rebound, and you should consider seeking financial advice before changing your investment strategy in that way.

Selling investments during market downturns to avoid short-term losses is a common (but unhelpful) human behaviour that can harm the ability to achieve long-term financial goals.

Investing successfully for retirement relies on a steady focus and not being distracted by the twists and turns inevitable on any long journey.

What about if I'm close to retirement?

After a long period of positive returns, we understand that it’s hard to see negative returns in your super, especially for members in or near retirement. But even many members close to retirement can afford to take a long-term view.

That’s because most people won’t take out all their super when they retire and could still have their super invested for up to 10-20 more years. With a substantial amount likely to stay in the super system in the retirement phase, often for many years, there is plenty of time for losses to be recovered.

What's the outlook?

After more than a decade of strong growth, our outlook suggests the risk of lower economic growth is rising which may lead to lower returns than in previous years. As the economic cycle progresses and markets respond, our investment team will continue to adjust the portfolio to manage risk. While times of uncertainty are difficult, we expect heightened volatility to lead to a renewed focus on solving urgent global problems, together with opportunities to invest wisely for the long-term.

Why should I trust Australian Ethical?

At Australian Ethical, we’ve been investing ethically since 1986. We take comfort in our years of experience and long-term performance figures. Ours is an approach that has been tested and proven over multiple cycles.

Even when short-term returns are down, our approach to constructing our investment portfolios and advocacy remains unchanged. It’s how you can be sure your money is still invested for a better world for people, planet and animals.

1 We consider an ethical fund to be one where all investments are not only investment focused, but also ethically screened.

Past performance is not a reliable indicator of future performance. Australian Ethical offers a diverse range of investment options depending on your investment objective, timeframe and risk profile. This information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs.

Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide and relevant product disclosure statement (PDS) and target market determination (TMD) available on our website. You may wish to seek financial advice from a licensed financial adviser before making an investment decision.

This article may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Australian Ethical accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.