australian ethical x coredata

Opportunity next

Capturing the great generational wealth transfer

With $3.5 trillion in wealth anticipated to change hands between Baby Boomers and a new generation of investors over the next two decades1, Australian Ethical and CoreData have partnered to deliver a new research report highlighting the role financial advisers will play in shaping the course of this generational wealth transfer and the advantages they stand to gain by embracing responsible investing as part of their advice proposition.

Report insights

Client retention

Savvy advisers are initiating wealth transfer conversations to retain clients

The needs of next-gen clients

How Gen X and Millennials invest won’t resemble the ways of their parents

Tapping into RI

Client satisfaction increases when responsible investing is part of advisers’ value proposition

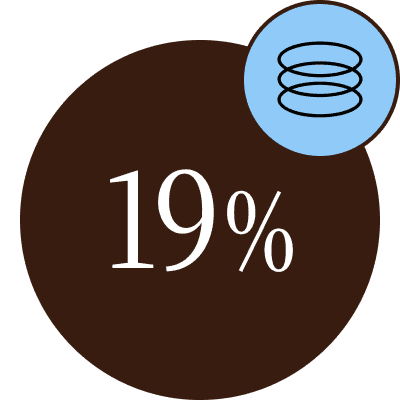

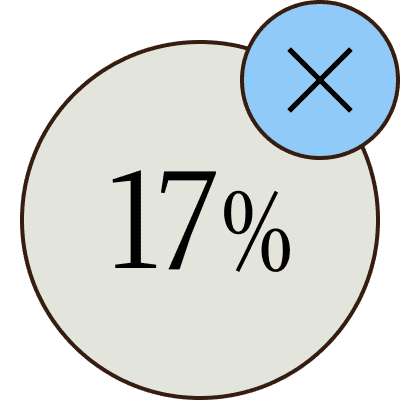

How advisers are addressing the opportunity

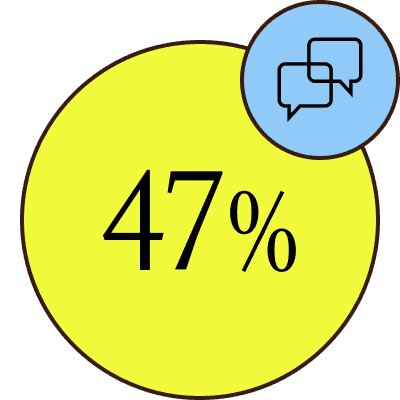

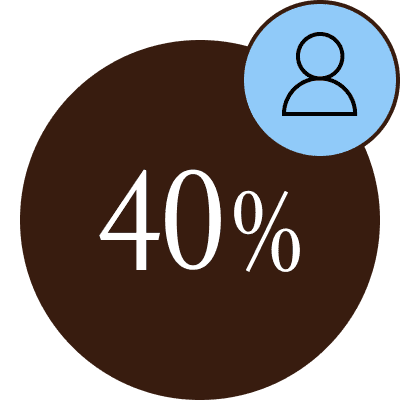

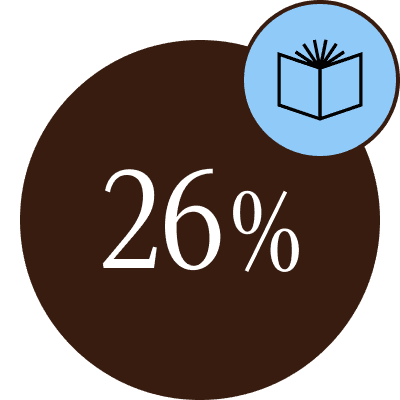

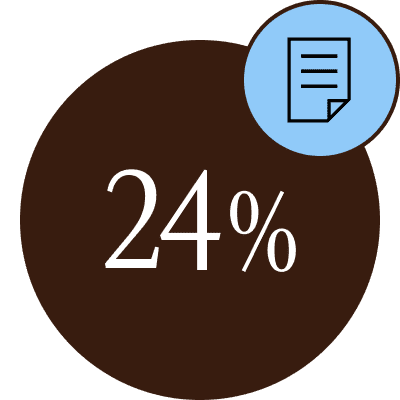

Initiating family conversations

Engaging clients now

Further education and learning

Quantifying the opportunity in my business

Developing a proposition for the segment

No current plan

Get the full scoop

‘Opportunity next’ uncovers:

- How savvy advisers are leaning into this opportunity to protect the future value of their practices.

- The responsible investment needs and expectations of a new generation of prospective clients who will inherit this wealth.

- Steps you can take to address wealth transfer opportunities in your practice.

Productivity Commission 2021, Wealth transfers and their economic effects, Research paper, Canberra; pc.gov.au/research/completed/wealth-transfers

Unless stated otherwise, this information is based on research designed and produced by CoreData Research (CoreData) in collaboration with Australian Ethical Investment Ltd. The survey was conducted from 29 of September 2023 to 19 of October 2023 and responses were gathered via an online quantitative survey. Overall, n = 300 completes were captured in the survey. The survey covered topics such as advisers' perceptions of intergenerational wealth transfer and their approaches to addressing it in their practices, and the growing demand for responsible investing products among both advisers and their clients. Information from CoreData’s syndicated studies, the Adviser Pulse Check and Investor Sentiment Index, were also used in this paper to provide further background and context.