Earnings season wrap: Opportunities in Aussie shares

While the earnings season triggered only modest downgrades, it was the ‘Trump tariff’ headlines that accentuated share market swings, creating opportunities for our active stock picking style of investing.

Last year, our portfolio managers were cognisant of elevated valuations in the Australian share market, but a pull-back seven-month lows in February and March has prompted us to deploy capital into attractively priced, quality companies.

In recent weeks, we bought shares in biotech giant CSL and hotel booking company SiteMinder. Meanwhile, hospital tech company Nanosonics, general insurer Suncorp, and payments infrastructure company Cuscal showed positive signs of earnings and profit-growth ahead.

Our investment in health insurer NIB also delivered strong returns off the back of a pleasing earnings result.

CSL upsized

We increased our investment in CSL shares in February after the company’s share price dipped, taking its price-to-earnings relative valuation to a 15-year low. CSL had not been held in our Australian Shares Fund for many years because its valuation was too rich for our liking - until we were presented with an opportunity to start taking a closer look in November last year.

We like the margin expansion in CSL’s core plasma business, which represents the bulk of our valuation in the company. We saw CSL’s lower result from the vaccines division as cyclical rather than representing a long-term trend. We note that flu hospitalisations rose sharply in the US following the lower vaccination rate, which means we think there will be a recovery to support CSL’s vaccine business in the next season.

Deploying cash

Our Australian Shares Fund built up cash reserves of up to 8.2% towards the end of last year as valuations continued to rise.

Valuation discipline is a core characteristic of our style and approach, reflecting the bottom-up fundamental process driving our stock selection. This means we are reluctant to overpay for companies or chase price/earnings momentum.

With the local share market correcting in March, we took the opportunity to deploy capital into select opportunities. Cash levels in our Australian Shares Fund are now closer to around 6%.

Hidden gems – Nanosonics, SiteMinder & Cuscal

Undervalued earnings growth and the potential for future earnings not yet valued or understood by the market were a focus for our portfolio managers during this reporting season.

Nanosonics, a long-time investment in our microcaps portfolio, revealed some good news relating to the progression of its new medical device cleaning system, Coris, through the US Food and Drug Administration’s new device review process.

Meanwhile, a selloff in SiteMinder’s shares this year provided an opportunity for our Australian Shares Fund’s to back the hotel booking company’s management to deliver on its ambitious annual growth ambitions in the years ahead.

Similarly, we like the management team of recent ASX debutant, Cuscal, and back the management team of the payments company to deliver on its ambition growth plans too.

We are optimistic about the potential for growth in pockets of the Australian share market and believe this market can provide opportunities to buy share in line with our valuation expectations.

Source: FactSet

Stock picker's market

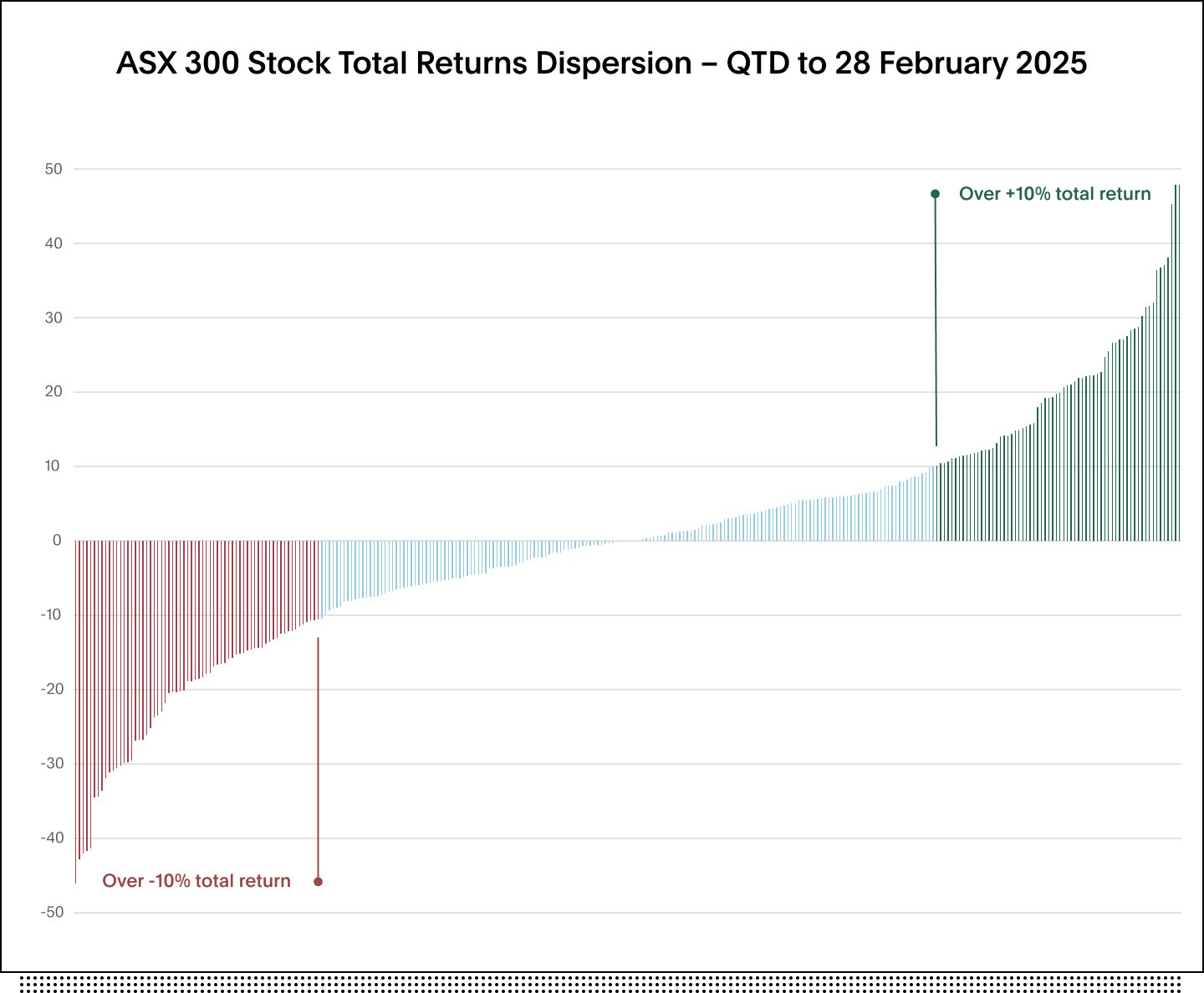

Analyst reports have described this earnings season as the most volatile earnings season on record, with 20% of the companies that posted results experiencing a 10% price swing in either direction. This compares to the historical average of 8%.

These price swings create return dispersion, which is the perfect environment for stock pickers like us to invest.

We expect there to be more possible buying opportunities ahead and remain poised to pounce on quality companies at reduced valuations.

Even though the local economy is showing positive signs for growth – with falling inflation and with interest rates expected to continue to ease – fears of a US recession and ongoing trade wars could mean more price corrections globally. Our pioneering and authentic ethical investment approach has navigated every market scenario, achieving more than 30 years of ethical outperformance.

Analyst reports have described this earnings season as the most volatile earnings season on record, with 20% of the companies that posted results experiencing a 10% price swing in either direction. This compares to the historical average of 8%.

Disclaimer

Interests in the Australian Ethical Managed Funds are issued by Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949), the Responsible Entity of the Australian Ethical Managed Funds.

This communication has been prepared for use by advisers only. It must not be made available to any client and any information in it must not be communicated to any client.

The information in this summary is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the Financial Services Guide, relevant product disclosure statement and Target Market Determination available on our website.

You may wish to seek financial advice from an authorised tax or financial adviser before making an investment decision. Past performance is not a reliable indicator of future performance.

This commentary may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Australian Ethical accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.